Monash University Law Review

|

Home

| Databases

| WorldLII

| Search

| Feedback

Monash University Law Review |

|

URS LUTERBACHER AND PETER DAVIS

The politico-economic literature has a tendency to discard the importance of unilateral measures of cooperation taken by individual states or local entities. This is particularly the case for greenhouse gas (‘GHG’) emission reductions. Often, such efforts are portrayed as being either useless or even counterproductive because of leakage effects. This paper aims at showing that a case can be made for such unilateral efforts under two conditions: first, if greenhouse gas reductions have ancillary benefits; and second, and more importantly, when the probability of the implementation of a global regulatory framework increases. Such an increase will induce investors to abandon investments in high carbon producing technologies for low carbon ones. Moreover, it will lead more and more countries and local entities to introduce regulatory frameworks, which, in turn, restrict the use of high carbon production methods.

In the aftermath of the international climate conference in Copenhagen, the difficulty of negotiating and implementing a comprehensive international agreement for climate change mitigation has become apparent. There has been some progress over the last decade towards the formation of an international climate protection regime, but for those who see climate change as a dangerous and potentially irreversible crisis, progress at the international level has been frustratingly slow. This frustration is often perceived to be the driving force behind the proliferation of numerous national and sub-national climate change mitigation policies. Their existence raises the question of the importance of unilateral moves to foster international cooperation by sometimes relatively small states or even sub-national entities.

The causes and impacts of these sub-national and regional voluntary attempts at cooperating internationally and, in this specific instance, at reducing the emissions of GHGs are increasingly a subject of interest to social scientists. Whether these programs will ultimately have a significant and durable impact on climatic change depends on the underlying rationale that is driving their development. If these programs are not more than outbursts of exasperated protest, as they are sometimes depicted by the politico-economic literature, then they might be predicted to peter out as their costs rise. If, however, unilateral regulation of GHGs is locally rational — and not just costly philanthropic behaviour — then these programs might be dynamically stable or even dominant.

Our paper wants to develop a rational explanation for local and regional governments regulating their GHG emissions before the negotiation and implementation of an international regime. This argument is unique in that it employs the concept of carbon leakages — a concept that is generally seen as deterring unilateral regulation — to demonstrate a considerable first mover advantage in regulation. The key point of the argument is that in a finite world with durable capital goods, no individual, municipality, or nation has an interest in owning carbon-intensive capital goods when these goods eventually go out of style. Carbon leakages, therefore, allow the unilaterally regulating society to smooth its transition to a low-carbon economy.

Following a review of the relevant literature, the first part of the paper develops a model of investor behaviour that explains the partial divestment from carbon-intense capital if investors expect carbon prices to rise in the future. The second part of the paper extends the analysis to the societal level, demonstrating that, even if private investors have some incentive to divest from carbon-intensive capital, they do not fully internalise the costs of their risky investments. Factoring in externalities from carbon-intense production, societal risk and time preferences creates an even stronger argument for unilateral regulation of GHG emissions, regardless of the impact of such regulations on global GHG emissions.

Finally, the paper explores the impact of a marginal regulator on the incentive structure of the remaining non-regulators, concluding that regulation in one region leads to the concentration of carbon-intense capital in the remaining non-regulating regions. This, in turn, should encourage remaining non-regulators to adopt regulation, because of the increasing external costs of carbon-intense production, and because of the increasing risk of carbon-intense capital. This process would hence result in a gradual transition to a low-carbon economy. In addition, when costly punishment is allowed, a critical-mass coalition of regulators will exist that is able to instantly coerce all remaining non-regulators to adopt regulation.

The majority of the politico-economic literature on climate change treats GHG emissions as a pure global public good and, therefore, disregards unilateral regulation as at best idealistic and ineffective, and at worst counter-productive. The objective of this paper is to challenge this conclusion, thereby questioning the epistemic foundations of this discussion.

The majority of political and economic scholarship on climate change mitigation deals with the issue of negotiating, implementing and enforcing a comprehensive international regime. Contributions to this debate generally focus on the problem of designing an efficient, yet feasible, mechanism for achieving a socially optimal level of GHG emissions: one which distributes costs and benefits ethically and efficiently across space and time. The emphasis on the international level has overshadowed a marginal scholarship on the local decision-making processes that can directly, or indirectly, influence GHG emissions and global climate change negotiations.

Even among economists who study unilateral regulation, it is commonly argued that local action to reduce GHG emissions will have negligible, or even perverse, effects on aggregate global emissions. This argument is formalised by Michael Hoel whose game theoretic model consists of two representative individuals who make decisions regarding a purely public good, anticipating the expected responses of each other.[1] The conclusions of Hoel’s game theoretic approach to public goods are very negative about unilateral emissions regulation. Accordingly, not only would the degree of unilateral regulation be below the globally optimal level, but, in addition, the effects of unilateral emissions reduction on global emissions would be diluted by international carbon leakage. Hoel also argues that unilateral emissions reductions would reduce the bargaining power of the regulating country in international negotiations, thereby diminishing the chances for establishing a future global climate change regime.[2] Certainly, the diminished role of the European Union in the recent climate change negotiations gives some weight to Hoel’s argument. However, Hoel’s bargaining power argument is not always convincing. If the unilateral regulator, within the process of international negotiations, has the ability to inflict costly punishments on parties that are not engaging in efforts to reduce GHG emissions, this can strengthen his bargaining position.

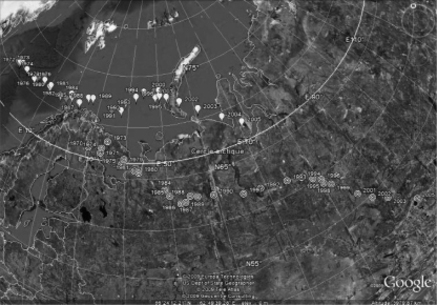

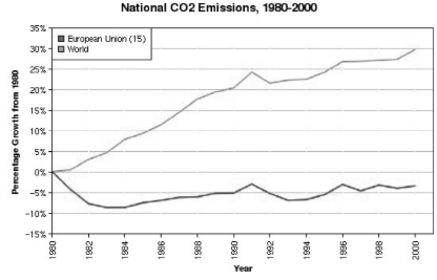

Nevertheless, a number of empirical studies demonstrate the significance of carbon leakages. In a simulation, Felder and Rutherford found that marginal leakages to be in the order of 25 per cent.[3] Babiker empirically measured carbon leakages and found them to be as large as 50 to 130 per cent.[4] According to Weiner, such large leakages can be attributed to the unexpectedly fast shift of emissions towards Asia.[5] The accelerating shift of carbon-intensive production towards Asia is visually presented in Figure 1, while Figure 2 demonstrates the insignificant impact of European regulation on global GHG emissions.

Figure 1: Global CO2 Emissions Centre of Gravity (1970–2005)[6]

Figure 2: The Impact of European Emission Reductions on Global Emissions[7]

Nonetheless, the last decade has seen a proliferation of unilateral actions to reduce GHG emissions. From its inception in 1993 to its international progress report in 2006, the Cities for Climate Protection (‘CCP’) campaign grew to involve 546 municipalities representing 20 per cent of global GHG emissions.[8] The CCP program has since continued to grow and now involves more than 1000 municipal participants.[9] Lutsey and Sperling estimated that 53 per cent of the US national population lived in a state or city that had a target for GHG emission reduction in 2007.[10] In China, plans are underway for a new city of half a million people in Dongtan that will generate zero contribution to global warming.[11] Further evidence of the scale of unilateral actions is available from a number of sources including Rabe, Betsill and Bulkeley, and Collier and Löfstedt.[12]

Given that unilateral GHG emission reduction will not have a significant, or could even have a perverse effect on the level of global GHG emissions, how can the proliferation of unilateral actions be explained? There are two categories of arguments to solve this puzzle.

The first category of arguments asserts that if unilateral climate change actions are to be rationalised, they must have an expected impact on global GHG emissions. These arguments are of two types: individuals could form systemically incorrect expectations; or individual behaviour could have an indirect impact on global GHG emissions through its influence on the attitudes and actions of others. Both versions require that unilateral actors are either conceived as irrational, or as quasi-rational normative agents. Schreurs and Tiberghien present such a conception as an explanation to the puzzle of consistent European Union leadership in climate change mitigation.[13]

The second category of arguments asserts that for unilateral climate change policies to make sense, these must have a positive expected utility benefit for the actor, regardless of their impact on global GHG emissions. Do individual actors have an incentive to reduce GHG emissions, independently of the climatic impacts of these actions? And do cities and regions have an incentive to regulate GHG emissions in the absence of an international climate change regime?

The problem with the irrational and quasi-rational type of explanations is that they do not deal with the free-rider problem in a satisfactory way. Often, the mere appearance of emissions reductions can be as effective as their actual existence in influencing the general public because information about them is difficult to evaluate. This creates the perverse incentive for corporations and governments to ‘green-wash’ their practices, rather than to achieve real and costly transformations.

A rational explanation for unilateral emissions reduction is one that, in evolutionary terms, improves the welfare of a unilateral actor. In evolutionary models, a behavioural strategy improving the welfare of an individual entity can be expected to be dominant or even dynamically stable. If this is the case for unilateral actions on climate change, then such strategies will probably replicate themselves over time. Schreurs and Tiberghien’s argument while eloquently articulated and heuristically interesting, fails to satisfy this condition.

There are few existing rational actor models that explain unilateral climate change mitigation. Urpeleinen, in his two-level game, touches this issue by showing how experimentation by lower levels of government, like the State of California, reduces the uncertainty of political costs and benefits at the national level.[14] The national leadership might, therefore, prefer sub-national policies. This is an effect that the International Energy Agency has termed the Real Options Approach.[15]

Urpeleinen only marginally addresses the root causes of what he calls the ‘Schwarzenegger phenomenon’.[16] Urpeleinen’s explanation of unilateral action requires GHG emission reduction to be an impure public good — meaning that some benefits of abatements accrue directly to the region. Urpeleinen then admits that ‘impure public goods provide at most a partial explanation for local climate policy’.[17]

Urpeleinen is not alone in perceiving ancillary benefits of reducing GHG emissions as the driving force behind local climate change initiatives. Koehn, for example, emphasises the importance of explicitly associating co-benefits of emission reduction strategies in the promotion of local climate change initiatives.[18] The author explores several instances where the reduction of GHG emissions has potentially ancillary benefits at a local and regional level. These benefits include reduced environmental degradation,[19] diminished resource consumption and depletion,[20] and health-related effects[21] as well as the economic benefits from improved energy efficiency. All of these co-benefits constitute rational explanations for why a local or regional government would choose to regulate GHG emissions unilaterally. However, not taking into account global aggregate emissions implies that the level of regulation due to ancillary benefits will always be sub-optimal.

Our approach introduces the concept of corporate sustainability — or a contrario the risks associated with corporate un-sustainability — as a rational solution to the puzzle of unilateral GHG regulation. In this sense, Richardson evokes the emergence and evolution of the concepts of corporate social responsibility, socially responsible investment and corporate sustainability.[22] The author is pessimistic, however, about the real possibility for corporate sustainability to have a significant impact in reducing GHG emissions. This is because he perceives the movement to have lost its ethical, ideological and normative foundation:

For most investors, global warming is (at most) mainly a matter of financial risk or investment opportunity. With decision-making in financial institutions dominated by fund managers and other investment professionals focused on the ‘bottom line’, any notion that such institutions are a forum of enlightened ethical deliberation among climate-conscious investors would be naive.[23]

Echoing Richardson, the Dow Jones Sustainability Index (‘DJSI’) maintains that ‘a growing number of investors perceive sustainability as a catalyst for enlightened and disciplined management, and, thus, a crucial success factor’.[24] Klaus W Wellershoff, Global Head of UBS Wealth Management Research, and Kurt Reiman, Head of Thematic Research at UBS Wealth Management in their report Climate Change: Beyond Whether, add:

Whether or not you agree with the view that human activity is influencing the climate system is largely irrelevant to the investment thesis. What is important is that numerous policies to combat the threat of global warming are converging to influence people’s behavior, alter the risk profile of various businesses, and improve the investment outlook for others.[25]

We intend here to demonstrate that the concept of corporate sustainability can have far more significant consequences for international climate change mitigation than is the case for notions centering on corporate philanthropy or altruism. The rational expectations of firms regarding future regulation can create an incentive for investors to unilaterally divest from carbon-intensive industries before international negotiations are achieved.

We will now proceed to formalise the micro-economic and political components of this argument and explore the impact of divestment on the incentives for local and global GHG emissions regulation. When local externalities and imperfections in capital markets are considered, a strong case emerges for unilateral GHG regulation, irrespective of its impact on global GHG emissions.

In this section we will suggest the principles of a simple micro-economic model of individual behaviour resulting in GHG emissions in a large society of N individuals.[26] In this model, a representative firm produces output using two technological processes with inputs of capital and carbon.

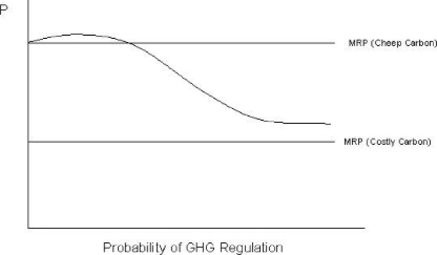

The first process is carbon intensive, while the second process is capital intensive. Carbon is a variable input that must be purchased in each period and is totally consumed in the production process. Capital purchases spillover into the next period. Investors tailor their investment portfolio in such a way as to reflect their preferences for carbon-intensive and low-carbon capital investment. The investors’ utility gained from investment is a function of the net present value of future wealth, but also of the expected variance or risk associated with different investment decisions. In order to make rational decisions about long-term investments, the investors must have a set of expectations about the future prices of capital in the two sectors. Several factors determine these prices and are therefore taken into consideration by a rational investor. The price of carbon is determined by environmental scarcity, by demand, and by government regulation. A rise in the price of carbon could be triggered, for instance, by the implementation of an international climate change mitigation regime, or by a sudden decrease in the availability of hydrocarbons.

As a baseline, it is useful to consider the relative price of the two capital goods in a society that does not consider expectations about future price. Prices are therefore determined by the equilibrium condition in which the marginal revenue products of all inputs are equal.

As a consequence, in a static environment, an investor will be indifferent between different portfolio compositions. There are, however, a number of external shocks that can influence the relative prices of capital goods in the future. Firstly, technological advancement in the production of low-carbon capital can cause the relative price of low-carbon capital to fall. This creates a bleeding edge effect of early adaptors paying unreasonably high costs. The bleeding edge effect might be offset by subsidies, regulatory incentives, or by intellectual property rights that enable early adaptors to earn rents from future technological advances.

Another potential shock to the relative price of capital goods would be caused by a rise in the price of carbon. The resulting technical substitution to low-carbon technology would determine demand for carbon-intensive technology to evaporate. The higher the ratio of carbon-intensive capital in the individual’s investment portfolio, the more exposed the individual is to the impacts of a change in carbon prices. A risk-averse investor may choose to divest from carbon-intensive capital, if he/she expects the price of carbon to rise in the future. This is analogous to a forward-looking individual divesting from a pyramid scheme or market bubble before its inevitable collapse.

As the international community approaches a comprehensive climate change agreement and uncertainty in low-carbon technology decreases, the number of investors divesting from carbon-intense capital is expected to increase, while the demand for carbon-intense capital should begin to decline. As the price of carbon-intensive capital decreases, risk preferring or myopic investors will increase their portfolio share of carbon-intensive capital and earn temporary economic rents on the cheap capital.

Figure 3: Price and Marginal Rate of Production of Carbon Intense Capital

This process may not lead to drastic reductions in aggregate GHG emissions in the short term, but it has the beneficial effect of discouraging new investments in carbon-intense capital, because the supply of new capital is determined purely by its production costs. The other effect of this process is to concentrate carbon-intensive industries in the portfolios of unscrupulous and risk-preferring investors. The combination of this factor with the existence of ancillary benefits from reducing GHG emissions creates a strong incentive for regulation at the local and national levels.

This section illustrates a dynamic representation of local and regional GHG emissions regulation. It shows that regions have an incentive to regulate GHG emissions before the implementation of a comprehensive climate change mitigation regime. Furthermore — and contrary to the pure public good model — it becomes evident that when other regions increase their regulation of GHGs the appropriate response is not to decrease regulation. Because of the nature of the ancillary benefits, there is instead a strong first mover advantage towards a tougher regulation.

Societal intervention in the market is only efficient when the interests of individual actors diverge from the interests of the society as a whole. The function of societal intervention is to force actors to internalise the social costs of their behaviour. Intervention is called for in the case of GHG emissions for a number of reasons.

First of all, intervention is required if the expected costs of anthropogenic climate change exceed the costs of mitigation. This is the global public good argument. However, this potential benefit of regulation appears diffuse at the local level, with the result that local community leaders will likely not internalise the full benefits of averting climate change into their decision-making process.

There are, however, a number of social benefits deriving from regulation that can be internalised at the local and regional levels, and which are not limited to the ancillary benefits mentioned above. Drawing from the previous section, it is plausible that there will be costs associated with a sudden loss of wealth that are not internalised by capital owners. If a large percentage of a community’s wealth and productive capacity evaporates overnight, for example, jobs would be lost and the community could potentially fall into a phase of recession. For this reason, carbon-intensive investments can be seen as having societal risks that are not internalised by private investors.

The divergence of private and public interests is exacerbated when regulation is in place and investors expect to be compensated for their investments. There exists a well-established norm of compensation that seeks to avoid an immediate and abrupt step into a new and unfairly punitive regulatory regime, and that attempts to smooth such transition by avoiding some of the immediate costs. This norm has been respected, to some extent, by land-reform programs, the emancipation of serfs and slaves, as well as by various alcohol prohibition programs. The pragmatic explanation for this norm is that, without compensation, the capital interests harmed that have been harmed by the regulatory reform have an incentive to use their political clout to obstruct the reforms. Then, if this norm is effective, private investors may not even fully internalise the private risks of their investments.

A final point is that even if private capital were to internalise the cost of future price shocks, there would still be a case for societal intervention. This is because risk and time preferences of the society may differ from those of the private sector. This argument may seem controversial with that of classical economists. Baumol, for example, argues that public and private discount rates should be equal.[27] Recent scholarship instead, appears to better accept the idea that society should be more patient and risk-averse than the private sector.[28] Societies, in fact, have incentives to regulate GHG emissions that go beyond the mere gain of the typical ancillary benefits. Societies that choose not to regulate do so because increased risks and pollution are seen as acceptable trade-offs for increased activity, or because of a lack of information regarding the true costs and risks associated with carbon-intensive capital, or because of inefficient political markets, or, finally, because the administrative costs of regulation exceed the technical capacity of governance.

Taken all together, these barriers create a frictional cost that tends to discourage smaller and less politically developed societies from adopting GHG regulations. The existence of frictional costs is confirmed by Robinson and Gore’s work on barriers to municipal regulation in Canada.[29] On a similar note, Collier and Löfstedt’s work on the experience of municipal governments attempting to regulate GHG emissions in Sweden and in the United Kingdom also illustrates the influence of such costs.[30]

But how will the utility of regulation change when a neighboring society implements stricter regulations? The classical approach suggests that the probability of an international regime is inversely related to the proportion of societies having GHG emissions regulations in place. Hoel’s bargaining power argument also suggests that when a society regulates unilaterally, it gives up emission reductions that could have been used in negotiations to obtain concessions from other parties.[31] In the present work, we argue instead, that an increase in the number of regulating societies will not only increase the likelihood of an international regime, but will also strengthen the incentive for non-regulating societies to introduce their own regulation.

When a society regulates unilaterally, it accepts a loss of productivity with respect to non-regulating societies. This creates an economic transfer between the regulating and non-regulating societies, up until an international agreement is reached that forces all societies to regulate. Regulating societies, therefore, have an incentive to hasten an international agreement by punishing non-regulating societies.

Assume that x percent of societies unilaterally regulate GHG emissions, and 1-x percent of societies remain unregulated. The total economic costs of carbon leakages are a strictly increasing function of x, because marginal leakages are assumed to be strictly positive. A coalition of regulators will, therefore, choose a punishment level that is increasing in x. The costs of this punishment will be then divided between regulators and non-regulators.

This conceptualisation hence makes x a critical point. Before this point, punishment is irrational because it will determine a greater cost to the marginal regulator than to existing non-regulators, thus effectively deterring regulation. After the critical mass of regulators is reached, however, the punishment of a large number of regulators is concentrated on a small number of non-regulators. From this point onwards, the incentive for non-regulators to join the coalition of regulators is strictly increasing in x.

The process above may be enhanced by exponentially increasing the ancillary costs of non-regulation as carbon-intense capital moves into the remaining non-regulating regions. As x becomes larger, the few non-regulators will be flooded with risky carbon-intense capital. Once the ball is rolling, this system will eventually produce the stable Nash equilibrium where all societies regulate GHG emissions (with or without an international regime) and the societies that adapt last pay the highest price. Quite clearly, this outcome will depend upon the increased probability of a generalised regulatory regime. How can this probability be determined?

Building upon the work of Milnor and Shapley on ‘oceanic players’,[32] Straffin observes that an increase in the size of a coalition at the expense of another is determined by the greater advantages the members of the second coalition can gain by joining the first one.[33] This concept can also be expressed by comparing the marginal advantage that members gain when switching from one coalition to the other. At the limit, one can calculate a critical value of x for which a coalition of regulators will either augment or diminish. In contrast to Straffin, we consider that the coalition of regulators is the only structured one whereas non-regulated entities behave as unaffiliated voters. This is consistent with Milnor and Shapley’s description of oceanic games where the set of major players is reduced to one member.[34] This does however not change the validity of our argument.

If x goes beyond this critical value, the coalition of regulators will keep increasing at the expense of the non-regulators until it completely takes the latter over. If x is below the critical value instead, the takeover will remain uncertain. This critical value of x allows us to compute a takeover probability for the coalition of regulators, which will simply be the actual number of regulators over the critical value that is necessary for the coalition of regulators to prevail.

We conceive the advantage of being part of a coalition of regulators simply as a marginally decreasing but ever increasing function of the number of its members. On the other hand, the non-regulators will benefit through leakage from the increase in the number of regulators, but will also expose themselves to an increasing level of sanctions from a larger number of regulators. Obviously, the higher the capacity to inflict sanctions from the regulators’ side, the lower the rewards from leakage, the lower the critical positive value of x, and thus the greater the likelihood for the x coalition to overcome the coalition of the non-regulators. In addition, if at some point the capacity to inflict sanctions is greater than the rewards from leakage, the success of the x coalition will be immediate. When this is the case, investors will quickly shift from high to low carbon technology capital investments and thus unilateral restriction measures will become the rule.

We proposed here a rational explanation for local and regional governments to unilaterally regulate GHG emissions. Both investors and the regions in which they invest have an incentive to minimise their exposure to regulatory risk. Ancillary costs to society from the emission of GHGs encourage governments to regulate GHG emissions beyond the private sector equilibrium. The incentive to regulate unilaterally is even stronger if the private sector does not adequately internalise systemic risks or if the private sector’s risk and time preferences differ from those of the society.

Initially, unilateral regulation will have a marginal impact on global GHG emissions and will be prohibitively expensive for the regulators. At this stage, purely rational societies will avoid making definitive commitments to GHG regulation, rather choosing to make nominal commitments and explore the potential of further investments in low-carbon technology. As the costs of low-carbon capital stabilise, the ancillary costs of carbon emitting activities rise, and a coalition of regulators develops, however, more and more societies will choose to regulate GHGs — despite the absence of an international climate change agreement. Once the coalition of regulators reaches a critical mass — determined through the considerations of which above — it will then be able to coerce the remaining non-regulators into an international agreement.

Non-regulating municipalities and regions may temporarily benefit from increased economic activity, but these benefits will soon be eclipsed by the ancillary costs and risks associated with carbon-intense capital. Eventually, when all societies come under the umbrella of an international climate change regime, non-regulating societies will pay the highest price, because of the resources they have sunk in long-term carbon intense capital. Still, the governments of these regions might be unable to regulate due to inefficient political markets, the lack of technical capacity, or an insufficient awareness of the risks associated with GHG emissions.

This understanding of carbon leakages suggests the following question: Where will the carbon intense economy leak to when China regulates GHG emissions? And where will it leak to after some new ‘haven’ has been found and regulated?

Clearly, there is no long-term advantage from engaging in an environmental race to the bottom. Eventually, the world is obliged to realise the transition to low-carbon technology. Forgetting this consideration represents the fundamental flaw of those models that conceptualise emission abatement as a pure global public good. Research on regime theory and institutional design is interesting and important, but it should not disregard the potential significance of complex individual and regional attitudes and behaviours that emerge even in the absence of a full-fledged international regime.

A Basic Micro Economic Model: 2 Industrial Processes

The inputs in process 1 are capital (K) and extracted carbon (E). The inputs for process 2, which is capital intensive, are simply Capital (K) and residual carbon (C):

where Y1 an Y2 are revenues associated with both processes.

To show that extracted carbon is an exhaustible resource we will introduce explicitly its rate of extraction through the differential equation:

, and we will assume that cS , the quantity of the carbon stock that

is extracted per unit of time is equal to E1, the carbon input to industrial process 1. The above differential equation, which can be written then also as:

acts as a constraint through time for the carbon intensive process.

Finally the exponent β1(1-γ/S) expresses the notion that if S →0, Y1→0. We can assume that α1 ≤α2 and initially also that β1(1-γ/S)≥β2. We can also assume that α1+ β1(1-γ/S) and α2+β2≤ 1

Clearly β1(1-γ/S) can become very small and eventually negative if either S becomes very small or if γ gets to be very large. We will assume this to be the case if, for what ever reason, carbon technology becomes obsolete or among other things if the probability of a carbon reduction regime increases. For the moment, we will assume here that ψ just represents an extraction rate at the global level. Clearly, if a political authority at a local level R can prohibit further extraction, it could do so by reducing ψR to 0 or to some minimal value. Assuming for instance that γR = 1/ψR , region R would stop producing with technology 1.[35] Clearly, at the global level, γ can be thought of as an increasing function of the price of carbon which itself will be determined in part by the probability p(x) of a takeover of a regulatory coalition at a world level such that eventually

Ownership of capital stock represents a flexible store of wealth for a modal investor in the firm because it can be divested to increase consumption at a given rate.

except when there is a significant probability that Yi → 0

The total wealth (W) of the investor at time t is therefore:

which can be decomposed into:

.

The investor’s utility function UI can therefore be described in terms of the net present value of the Wit , (NPV):

thus:

In other words, the utility function of the modal investor depends both on the expected net present value of his wealth and the variance around the expected net present value of it. We can reasonably assume that

To make rational decisions about long-term investment the investor must have a set of expectations about the future values of his or her capital in the two sectors. Obviously these will diminish for the carbon intense process if either the carbon stocks get progressively exhausted or if the carbon intensive technology gets obsolete or still if the probability of a generalised carbon restriction regime increases. In all these cases our factor γ will increase and/or the uncertainty around the value of γ will increase. In all these cases the NPV and thus the utility associated with its expectations will diminish for the modal investor who will therefore reduce his investments in the carbon intensive technology ad increase them in the capital intensive technology. In all this, the probability of the institution of a regulatory regime plays a considerable role. How can we determine such a probability?

According to Straffin following the work of Milnor and Shapley on very large amounts of players (oceans of players), the increase in the size of a coalition at the expense of another is determined by the greater advantages the members of the second coalition can gain by joining the first one.

This can be expressed mathematically by comparing the marginal advantage gained by members switching from one coalition to the other. If A(x) is the advantage members x (as before in percentage) can get from joining regulators and A(y) the advantage of staying with the non-regulators, a member of group y (percentage of non-regulators) will join group x if the marginal advantage of joining x is greater than staying in y or:

remembering that x + y = 1

The critical value is then obviously the positive value of x of the equation:

The probability p(x) of the x (regulator) coalition taking over is simply if

x< x critical:

where ε is an arbitrarily small positive value.

Now if we make the simplifying assumptions that A(x) is simply a marginally decreasing but ever increasing function of x such as ln (ax) , where a is an adjustment constant. We conceive A (y) as a linear function of x in the sense that the non-regulators benefit through leakage from the increase in regulators but expose themselves to an increasing level of sanctions from regulators (we keep this relationship linear here in order to avoid too many complexities in the calculation of the critical value). So if a constant B represents the rate of benefits accruing from a shrinking number of non-regulators while a constant C represent the rate of sanctions that the regulators can inflict upon non regulators, A (y) is then simply:

(B – C)x

We can now solve

remembering that x + y = 1. We get:

Obviously the higher the capacity to inflict sanctions (C) and the lower the rewards from leakage (B), the lower the critical positive value of x and thus the greater likelihood for the x coalition to overcome the y coalition. Also if from the beginning, the capacity to inflict sanctions is greater than the rewards from leakage, then the success of the x coalition is immediate.

A regional authority will consider in our perspective the expected future income stemming from the two possible industrial processes as they affect the region R. Suppose that a regional authority considers regional income YR stemming from the two industrial processes:

with

We can assume that the regional authority wants to maximise:

with the constraint:

since the only part of the regional income YR that is affected by the constraint is YR1 we can restrict the problem to the maximisation of:

again with the constraint:

We can now assume that ψR is a control variable for the regional authority if it wants to regulate the situation. In other words, the authority may want to stop all extraction of carbon material by setting ψR equal to 0 or to some minimal value in order to favor income YR2 and eliminate eventually YR1. Under which circumstances will this decision be taken in an optimal way? For this the authority has to solve an optimal control problem through time by maximising the so-called Hamiltonian[36] function H. In our case here, this function is here written:

For this expression to be maximised, it can be shown [38] that the co-state differential equation:

has to be solved and the function αi(t) below has to be

smaller than 0 for ψ to be at its minimal value.[39]

where the vector bkt (x,t) represents the right hand side of the constraint equations ie here, -ψER1. Since it is negative by definition for positive ψ we need to examine what determines the sign of the –λ(t) solution (we have only one here) of the co-state equation. The co-state differential equation:

has as time solution:

. Where B is an integration constant. Evaluating –λ(t) we have:

In other words as soon as the weighted accumulated income from technology 1 falls below an exponential growth curve, then the regional government will curtail extraction. Again, this may occur in our scenario as a result of γR getting bigger following disinvestments due to the increased perspective of a generalised regulatory regime.

[1] See Michael Hoel, ‘Global Environmental Problems: The Effects of Unilateral Actions Taken by One Country’ (1991) 20 Journal of Environmental Economics and Management 55.

[2] Ibid 64.

[3] Stefan Felder and Thomas Rutherford, ‘Unilateral CO2 Reductions and Carbon Leakage: The Consequences of International Trade in Oil and Basic Materials’ (1993) 25 Journal of Environmental Economics and Management 162, 164.

[4] Mustafa Babiker, ‘Climate Change Policy, Market Structure, and Carbon Leakage’ (2005) 65 Journal of International Economics 421, 441.

[5] Jonathan Baert Wiener, ‘Think Globally, Act Globally: The Limits of Local Climate Policies’ (Paper No 93, Duke Law School Faculty Scholarship Series, Duke University, 2007).

[6] Jean-Marie Grether and Nicole Mathys, How Fast are CO2 Emissions Moving to Asia? (2009) [Figure 1] <http://works.bepress.com/cgi/viewcontent.cgi?article=1007 & context=nicole_mathys> at 27 January 2009.

[7] World Resources Institute, World Resources Institute (2010) <http://www.wri.org/> at 28 August 2010.

[8] ICLEI Local Governments for Sustainability, ICLEI International Progress Report: Cities for Climate Protection (2006) 2.

[9] ICLEI Local Governments for Sustainability, Cities for Climate Protection (CCP) Campaign <http://www.iclei.org/index.php?id=10829 at 16 June 2010> .

[10] Nicholas Lutsey and Daniel Sperling, ‘America’s Bottom-Up Climate Change Mitigation Policy’ (2008) 36 Energy Policy 673, 675.

[11] Peter Koehn, ‘Underneath Kyoto: Emerging Subnational Government Initiatives and Incipient Issue-Bundling Opportunities in China and the United States’ (2008) 8(1) Global Environmental Politics 53, 65.

[12] Barry Rabe, Mikael Roman and Arthur Dobelis, ‘State Competition as a Source Driving Climate Change Mitigation’ (2005) 14 New York University Environmental Law Journal 1; Michele Betsill and Harriet Bulkeley, ‘Transnational Networks and Global Environmental Governance: The Cities for Climate Protection Program’ (2004) 48 International Studies Quarterly 471; Ute Collier and Ragnar Löfstedt, ‘Think Globally, Act Locally? Local Climate Change and Energy Policies in Sweden and the UK’ (1997) 7 Global Environmental Change 25.

[13] Miranda Schreurs and Yves Tiberghien, ‘Multi-Level Reinforcement: Explaining European Union Leadership in Climate Change Mitigation’ (2007) 7(4) Global Environmental Politics 19.

[14] Johannes Urpelainen, ‘Explaining the Schwarzenegger Phenomenon: Local Frontrunners in Climate Policy’ (2009) 9(3) Global Environmental Politics 82.

[15] Ming Yang and William Blyth, ‘Modeling Investment Risks and Uncertainties with Real Options Approach — A Working Paper for an IEA Book: Climate Policy Uncertainty and Investment Risk’ (Working Paper No 1, International Energy Agency, 2007).

[16] Urpelainen, above n 14.

[17] Ibid 93.

[18] Koehn, above n 11.

[19] Ibid 62–3.

[20] Ibid 66–7.

[21] Ibid 67–8.

[22] Benjamin Richardson, ‘Climate Finance and its Governance: Moving to a Low Carbon Economy Through Socially Responsible Financing?’ (2009) 58 International and Comparative Law Quarterly 597.

[23] Ibid 602.

[24] Dow Jones Sustainability Index, Sustainability Investment <http://www.sustainability-index.com/07_htmle/sustainability/sustinvestment.html> at 20 June 2010.

[25] Klaus W Wellershoff and Kurt E Reiman, ‘Editorial’ in Klaus Wellershoff and Kurt Reiman (eds), UBS Research Focus — Climate Change: Beyond Whether (2007) 5, 6.

[26] For an explicit mathematical representation of our verbal description refer to the Mathematical Appendix.

[27] William Baumol, ‘On the Social Rate of Discount’ (1968) 58 The American Economic Review 788.

[28] See, eg, Andrew Caplin and John Leahy, ‘The Social Discount Rate’ (2004) 112 Journal of Political Economy 1257; Emmanuel Farhi and Iván Werning, ‘Inequality and Social Discounting’ (2007) 115 Journal of Political Economy 365.

[29] Pamela Robinson and Christopher Gore, ‘Barriers to Canadian Municipal Response to Climate Change’ (2005) 14 Canadian Journal of Urban Research 102.

[30] Collier and Löfstedt, above n 12.

[31] Hoel, above n 1.

[32] John W Milnor and Lloyd S Shapley, ‘Value of Large Games II: Oceanic Games’ (Rand Memorandum No 2649, The Rand Corporation, 1961) reprinted in (1978) 3 Mathematics of Operations Research 290, 290.

[33] Philip D Straffin Jr, ‘The Bandwagon Curve’ (1977) 21 American Journal of Political Science 695.

[34] Milnor and Shapley, above n 32, 290–1.

[35] Other more gradual scenarios could also be imagined.

[36] For all the discussion around optimisation through time see Donald Pierre, Optimization Theory with Applications (first published 1969, 1986 ed) ch 7.

[37] The λ in this expression is similar to a Lagrange multiplier except that instead of a constant, λ is in this case a function of time. λ is the solution of a co-state differential equation to be defined below.

[38] Pierre, above n36, 437.

[39] In other words what we have here is a so-called bang-bang solution where our control variable will switch according to favorable circumstances from a maximal value (such as 1) to a minimal value (such as 0).

AustLII:

Copyright Policy

|

Disclaimers

|

Privacy Policy

|

Feedback

URL: http://www.austlii.edu.au/au/journals/MonashULawRw/2010/5.html