Commonwealth of Australia Explanatory Memoranda

Commonwealth of Australia Explanatory Memoranda Commonwealth of Australia Explanatory Memoranda

Commonwealth of Australia Explanatory Memoranda[Index] [Search] [Download] [Bill] [Help]

AUTOMATIC

ANNUAL

ADJUSTMENT PROCEDURE

FOR

HEAVY VEHICLE

CHARGES

Regulatory Impact

Statement

September

2001

Prepared by:

National Road Transport Commission

with the assistance of Sinclair Knight Merz Pty Ltd

National Road Transport

Commission

Automatic Annual Adjustment Procedure for Heavy

Vehicle Charges Regulatory Impact Statement - September 2001

Report Prepared by: National Road Transport Commission with the assistance of

Sinclair Knight Merz Pty Ltd

ISBN: 0 642 54493 X

FOREWORD

This Regulatory Impact Statement is designed to accompany the entire decision

of the Australian Transport Council (ATC) to implement automatically an agreed

procedure for the annual adjustment of heavy vehicle registration charges.

At

the November 2000 meeting of the ATC, Ministers asked the National Road

Transport Commission, in consultation with the Standing Committee on Transport,

to prepare a formula for annual adjustment of heavy vehicle charges. That

formula was the subject of the Annual Adjustment Procedure for Heavy Vehicle

Charges: Regulatory Impact Statement (RIS) – May 2001.

At the following

ATC meeting in May 2001, it was agreed that heavy vehicle registration charges

would be adjusted annually by this formula, which is based on changes in road

expenditure, modified to reflect changes in road use by heavy vehicles. It was

further agreed that the initial application of the formula would take place as

close as possible to 1 October 2001, and that this would include a ceiling of

underlying inflation (Consumer Price Index adjusted to remove the impact of

changes to the tax system). The initial adjustment was made through the Road

Transport Charges (Australian Capital Territory) Amendment Regulations 2001.

Application of the adjustment is the subject of the Annual Adjustment Procedure

for Heavy Vehicle Charges – Initial Adjustment: Regulatory Impact

Statement - July 2001.

As stated above, the subject of this Regulatory Impact

Statement is legislation to put in place the automatic adjustment procedure for

heavy vehicle charges that was agreed by Ministers at the ATC meeting in May

2001. This procedure is to apply annually on 1 July each year, from July 2002

onwards (as agreed by Ministers).

It follows two closely related Regulatory

Impact Statements noted above, that is:

• Annual Adjustment Procedure

for Heavy Vehicle Charges: Regulatory Impact Statement, May 2001;

and

• Annual Adjustment Procedure for Heavy Vehicle Charges –

Initial Adjustment: Regulatory Impact Statement, July 2001

CONTENTS

LIST OF TABLES

LIST OF FIGURES

The National Road Transport Commission is responsible for regularly reviewing

the level of charges as part of its role to improve road transport’s

efficiency and safety and reduce its environmental impacts. The development of

nationally uniform charges on a national basis was one of the key reasons for

the establishment of the NRTC in 1991. Uniform charges are a key issue for the

road transport industry.

The NRTC is required to use the methodology set out

in the NRTC Act, and to make assessments as to whether charges are at the right

levels.

These assessments are contained in a “Determination”,

which is recommended to Australia’s Transport Ministers for decision. Two

Determinations have been made (in 1992 and 2000) and implemented by all

governments, and an initial application of the annual adjustment formula

occurred in most jurisdictions on 1 October 2001.

Decisions relating to

heavy vehicle charges are currently made on a zonal basis, with Zone A

comprising New South Wales, Victoria, Tasmania, the Australian Capital Territory

and the Commonwealth and Zone B comprising Queensland, Western Australia, South

Australia and the Northern Territory. The effect of the voting arrangements

that apply within each zone is that a majority must vote in support of the

proposal in order for it to be agreed, that is, at least 3 out of 5 in Zone A

must vote in favour, or at least 3 out of 4 in Zone B must vote in favour of a

proposal for it to go through.

Until now, the process used to determine heavy vehicle charges has

involved:

• establishing the amount and classification of road

expenditure Australia-wide;

• developing procedures to identify what

proportion of these costs are attributable to heavy vehicles, and on what

measure of road use they depend;

• establishing the number and use of

road vehicles by different categories; and

• estimating the range of

charges by vehicle type that fully recovers the expenditure.

The process is

undertaken by NRTC using a large spreadsheet model designed for the purpose,

gathering the necessary data and reviewing the basic assumptions made at each

determination. Data is collected, primarily from the jurisdictions and the ABS,

with supplementary surveys or investigations carried out to improve any

shortcomings in the available information.

This process results in a range of

charges for heavy vehicles that recovers road expenditure as consistently as

possible between the different types of heavy vehicle. The charges have two

components: a fuel excise component and a registration charge. Revenue from the

fuel excise component is part of general Federal fuel excise revenue, whilst

registration charges are collected by the States and Territories and used at the

discretion of each jurisdiction.

Because of the extensive consultation, data

collection and analysis required to undertake the cost allocation procedure,

full determination of charges has only occurred twice since the NRTC was

established, in 1995 (on a 1992-based analysis) and 2000 (on a 1997-based

analysis).

A 3rd Heavy Vehicle Charges Determination is included in the NRTC’s

strategic plan and is scheduled to be completed in 2003/04.

Given that the

next determination may be a few years away, NRTC has been requested to propose a

method to adjust heavy vehicle charges on an annual basis, so that they keep

pace with changing circumstances and potentially reduce the impact of a charges

review every 4-5 years.

At the ATC meeting of April 1999, Ministers asked the NRTC to submit a

proposal to them on the annual indexation of heavy vehicle registration charges.

The Ministers intended that indexation would apply in each of the years between

Determinations to ensure that charges kept pace with heavy vehicle road use

costs and to allow a smoother transition to the outcomes of future

Determinations.

Accordingly, the NRTC asked Ministers to vote on indexing

charges, commencing in July 2001. The proposal Ministers were asked to consider

involved indexing charges by changes in the Consumer Price Index, and would have

required Ministers to decide each year whether or not to apply the indexation

procedure.

This proposal was unanimously supported by Zone A Ministers.

However Zone B rejected the proposal as two jurisdictions (Western Australia and

the Northern Territory) voted against indexation. The proposal was rejected by

these two jurisdictions due to the impacts on remote areas.

This rejection

of the proposal created the potential to undermine the existence of nationally

uniform charges.

Governments worldwide face significant scrutiny in the manner by which

charges and taxes imposed on all aspects of society are determined, costed and

implemented. Agencies responsible for determining charges face the difficult

task of balancing competing interests, while ensuring that resulting systems are

equitable, justifiable, readily enforceable where required, and meet with a

generally high level of compliance.

Charges imposed on the operators of

heavy vehicles are no exception, and issues associated with the level of such

charges and related expenditure on various classes and location of roads have

been consistent subjects of debate for many years.

At the November 2000

Australian Transport Council (ATC) meeting, Ministers requested the Standing

Committee on Transport (SCOT) and the National Road Transport Commission (NRTC)

to develop an annual adjustment procedure for heavy vehicle charges:

“NRTC in consultation with SCOT will advise Ministers at their next

ATC meeting on a sound formula for annual adjustment to heavy vehicle

charges.”

The minutes of the last ATC meeting also indicated

that:

“In the event that there was no agreement on the adjustment of

charges, the “default” position was that Ministers would then vote

at the same meeting on the application of the CPI index minus the impact of

GST.”

An Advisory Group, comprising representatives of road

authorities, industry and specialist researchers (members as listed in Appendix

C) was convened to discuss the objectives and possible approaches that could be

adopted to adjust heavy vehicle charges.

The Advisory Group identified

objectives that jurisdictions would seek to achieve through an annual adjustment

procedure for heavy vehicle charges, and the relative importance of each, are

shown in Table 1.1. This

Table also contains the qualitative views of Advisory Group Members on the

relative importance of each objective.

Table 1.1 Annual Adjustment Objectives

|

Objective

|

Abbreviated title

|

Jurisdiction weighting

|

Industry views on importance

|

|

|---|---|---|---|---|

|

1

|

To increase revenue from registration charges so that they reflect

increased demands on Government resources

|

Revenue

|

21%

|

Similar

|

|

2

|

To ensure the resulting charges are efficient (match estimated costs of

road use) and provide continuity between charging determinations

|

Efficiency Weighting

|

15%>

|

Similar

|

|

3

|

To ensure that the resulting charges are equitable (they are fair and can

be justified)

|

Equity

|

20%

|

Similar

|

|

4

|

To provide a simple, readily understandable and transparent approach to the

underlying calculations

|

Simplicity

|

21%

|

Slightly greater

|

|

5

|

To minimise hardship on remote areas

|

Remote areas

|

23%

|

Similar

|

|

|

|

|

|

|

Objectives 2, 3 and 4 ensure that the approach adopted is consistent with

the charging principals set out in the Heavy Vehicles Agreement. Objectives 1

and 5 are additional objectives that were identified by the Advisory Group based

upon discussions with Ministers.

Three alternatives were presented to ATC for consideration. These

alternatives comprised:

1. the proposed annual adjustment formula requested

by Ministers at the last ATC meeting;

2. the fall-back position identified

at that meeting of indexing charges in accordance with underlying inflation

(that is, changes in the Consumer Price Index (CPI) less the impacts of the

introduction of the Goods and Services Tax); and

3. the original proposal of

indexing charges in accordance with changes in CPI, which was accepted by Zone A

and rejected by Zone B in February 2000.

It was decided that in the event

that both Zones approved the first of these alternatives, the other two would be

disregarded.

At the ATC meeting on 25 May 2001, Ministers agreed upon the

annual adjustment formula.

The annual adjustment formula for heavy vehicle charges agreed by Ministers

would adjust charges in accordance with changes in road expenditure and expected

changes in road use. It takes the form:

Adjustment (%) = 0.60 x Change

in Rural Arterial Expenditure (%)

+ 0.21 x Change in Urban Arterial

Expenditure (%)

+ 0.02 x Change in Urban Local Expenditure

(%)

+ 0.17 x Change in Rural Local Expenditure

(%)

– 1.5% (ie, Road Use Factor)

It was proposed that

the maximum increase in heavy vehicle charges would be limited to a

“ceiling” of underlying CPI (ie, CPI with the GST spike removed).

Reductions in charges will be avoided by including a “floor” of 0%.

The formula also takes account of where changes in road expenditure occurred.

The Road Use Factor of – 1.5 adjusts changes in road expenditure by

expected changes in road use. Expected changes in road use reflect likely

changes in vehicle numbers and the distances they travel. These likely changes

were estimated on the basis of trends over the past decade. Their importance

was established by assessing their influence on heavy vehicle charges using the

method of determining charges used in the 2nd Charges Determination.

Due to difficulties in accurately assessing changes in road use year to year,

the Road Use Factor has been fixed for the duration of the annual adjustment

procedure, that is, until the Third Heavy Vehicle Registration Charges

Determination.

Expenditure on roads that are more intensively used by heavy

vehicles has a greater influence than expenditure elsewhere. That is,

expenditure on rural arterial roads has a much greater impact on charges than

expenditure on urban local roads. This relationship in the charging model (as

used in the Second Charges Determination) is carried forward to the formula and

is the reason for different weightings for different categories of road

expenditure. The way these weightings were calculated is detailed in Appendix

D. In essence, they were derived by establishing what effect there would be on

charges from changes in different types of expenditure and different aspects of

road use (based on the charging model used in the 2nd Charges

Determination). If expenditure on all categories of roads increases by the same

proportion, the weightings have no impact.

The results of the formula are

in percentages. All changes in road expenditure are measured as percentage

changes between the average of the three most recent years of expenditure

compared to the average of expenditure in the previous three years (that is,

annual percentage changes between three-year moving averages of road

expenditure). The three-year average used to determine changes in expenditure

has the effect of smoothing out any large fluctuations year to year.

This section of the RIS identifies the range of options that were considered

to achieve the desired policy objectives. The range of options considered

extend beyond those that were submitted to Ministers for consideration and all

are described and discussed in this RIS.

The purpose of the adjustment

procedure is to provide a mechanism for regularly updating charge levels between

more complete reviews of charge levels in determinations. Although other,

non-regulatory approaches may be possible, the prime objectives of a heavy

vehicle registration system (vehicle identification and revenue raising) are not

readily achieved by other means.

A range of approaches to adjusting heavy vehicle charges is possible, from simple indexation based on a recognised index (such as CPI) to full annual recalculation of charges. The options identified and considered worthy of further consideration are as shown in Table 2.1.

Table 2.1 Options for Adjusting Heavy Vehicle Charges between Determinations

|

Option

|

Abbreviated Title

|

|

|

A

|

Full recalculation using the method applied in heavy vehicle charges

determinations.

|

Full recalculation

|

|

B

|

Applying a simplified formula that captures (but may not precisely match)

the main influences on charges in a full charges determination (ie. road

expenditure and road use).

|

Adjustment formula

|

|

C

|

Indexation based on changes in total road expenditure.

|

Expenditure Index

|

|

D

|

Indexation based on changes in the costs of inputs to roadworks (the road

construction price index – RCPI).

|

RCPI

|

|

E

|

Indexation based on Consumer Price Index (CPI).

|

CPI

|

|

F

|

Indexation based on CPI adjusted for the impact of the introduction of GST.

|

Underlying Inflation

|

|

G

|

No adjustment to heavy vehicle charges.

|

No Adjustment

|

These options were considered by the Charges Advisory Group as representing the most practical options available to adjust charges on an annual basis. Ministers were asked to formally consider three of these options, comprising Options B, E and F.

The options were developed as follows:

• Full Recalculation:

This option was not developed in detail as part of this assessment because of

the excessive resources required to do so, and the lack of data availability at

the present time. Any full recalculation would involve review of the underlying

assumptions, the cost allocation relationships (involving ongoing research into

heavy vehicle impacts on road pavements), and the base assumptions about which

costs are recovered, the relationship between the fuel and registration

components, and so on. It has been assumed that a full recalculation approach

would be too resource-intensive and too expensive to undertake

annually.

• Adjustment Formula: A full description of the

derivation of the adjustment formula is given in Appendix D. In essence, the

formula adjusts heavy vehicle charges in line with changes in road expenditure

(broken down between urban and rural arterial and local roads), adjusted for

changes in road use and the number of vehicles in the fleet.

As mentioned

above, Ministers agreed to use this adjustment formula for heavy vehicle

registration charges.

• Expenditure Index: This option involves

adjustment of heavy vehicle charges pro rata to annual changes in road

expenditure.

• RCPI: This option involves adjustment of heavy

vehicle charges pro rata to annual changes in the price of road construction and

maintenance, as defined by the published Road Construction Price Index (ref.

Bureau of Transport Economics).

• CPI: This option involves

adjustment of heavy vehicle charges pro rata to annual changes in consumer

prices, as defined by the Australian Consumer Price

Index.

• Underlying inflation: This option is the same as the

CPI option but would remove any one-off policy-related effects that might

distort prices; the introduction of GST caused such a distortion in 2000, for

example.

Some SCOT members requested the NRTC investigate the effects of

differentiating by broad vehicle types in the adjustment

formula[1]. Differentiating between

rigid trucks and articulated trucks (including B-doubles and road trains) was

investigated.

The analysis showed that if road expenditure increases at a

higher rate than CPI plus 1%, differentiating between vehicle classes has little

impact. If smaller increases in expenditure occur, increases in charges for

rigid trucks would be a little smaller, but there would be virtually no

difference in charges for articulated trucks. Further details of the analyses

are shown in Section 3.6.

Differentiating between articulated trucks with one trailer and B-doubles/road

trains is not worthwhile, as adjustments for each of these classes would be very

similar.

Overall, the complexity of differentiating between vehicle types in

the adjustment formula is not believed to be warranted. This is due to the fact

that little difference is likely to result in the adjustments to charges for

different vehicles (see Figure

3.3 in Section 3.6),

particularly if road expenditure continues to increase at a similar rate to

recent years.

The adjustment formula is weighted to ensure that adjustments to heavy

vehicle charges are most closely linked to road expenditure that is dependent on

heavy vehicle use. Expenditure on roads that has a greater impact on the heavy

vehicle share of road costs (based on the calculations used in the

2nd Charges Determination) is weighted more heavily. Consequently,

large increases in expenditure on urban roads and local roads would have a

limited impact on adjustments to heavy vehicle charges.

The adjustment

formula also provides a way to address the concerns of the remote areas without

differentially charging vehicles operating in these areas.

Alternative

approaches to taking into account concerns of remote areas and minimising the

hardship of charges adjustments on these areas, such as differentially treating

road trains or other vehicles used in remote areas have been canvassed. All

pose significant concerns (as outlined below), particularly for national

uniformity in heavy vehicle charges and inappropriate pricing signals.

Under the selected approach changes in charges for heavy vehicles by

applying the initial adjustment procedure were of a relatively small amount per

annum. Increases in registration charges ranged between $10 for the smallest

heavy vehicles and up to $295 for the largest. The adjustment formula provides

a justifiable mechanism for updating charges annually, and is therefore likely

to be more acceptable in remote areas than CPI-based indexation. This is due to

the fact that under a simple indexation approach, smaller increases in road

expenditure would not be reflected in smaller increases in heavy vehicle

charges.

One approach to minimising hardship on remote areas would be to

apply a smaller adjustment to road trains than other vehicles. However, there

is concern from some jurisdictions that the relativity of road train and

B-double charges established in the Second Determination should be maintained so

that the use of B-doubles is not discouraged. Concern was expressed that

B-doubles are widely accepted to be a safer vehicle type and charging less for

road train prime movers than B-double prime movers may encourage greater use of

a less safe vehicle. Moreover, adjusting B-double charges by a smaller amount

presents problems in more populous regions where road trains are not allowed and

B-doubles are used in competition to rail services.

The adjustment formula

adjusts charges in proportion to changes in road expenditure. Charges for road

trains could be adjusted in proportion to the change in road expenditure in Zone

B (the “remote” zone) only. However, this could result in a larger

increase for road trains than for other vehicles. For example, arterial road

expenditure grew by 12 per cent in Zone B and 11 per cent across all

jurisdictions between 1997-98 and 1998-99. If adjustments to charges for road

trains were linked to changes in expenditure in Zone B, this would have meant

that charges for road trains would in fact increase more than charges for other

vehicles.

Due to the fact that Ministers agreed to an initial adjustment taking place

as close as possible to 1 October 2001, the initial adjustment was made by means

of an amendment to the Road Transport Charges (Australian Capital Territory)

Regulations 1995.

It is proposed to put in place the automatic annual

adjustment arrangements to apply from 1 July 2002 through primary legislation.

That is, a draft amending Bill has been prepared titled Road Transport

Charges (Australian Capital Territory) Amendment Bill 2001. This Bill will

put in place changes to the Road Transport Charges (Australian Capital

Territory) Act 1993.

Alternatives would be to prepare annually

regulations to adjust the applicable level of charges or to rely on changes to

local legislation in each individual State and Territory. The first of these

alternatives is not practical as it would be too resource intensive. The second

would involve considerable additional effort for those jurisdictions that have

opted to adopt the ‘template’ approach to legislating charge levels

for heavy vehicle registration. This ‘template’ approach is the

approach to legislating road transport reforms envisaged in the National Road

Transport Commission legislation.

Due to the length of time between charges determinations, recovery of road

expenditure from heavy vehicles may be based upon figures that have become out

of date. The result of this is that costs of road use attributed to classes of

heavy vehicles are not being fully recovered. As the productivity of heavy

vehicles improves and road expenditure increases, the heavy vehicle share of

road construction and maintenance will increase further. It is important that

the level of road expenditure recovery match the cost recovery target. The

adjustment of heavy vehicle charges on an annual basis was seen as a way of

keeping pace with changing circumstances and would potentially reduce the impact

of a charges review every 4-5 years.

Registration charges from the

2nd Determination initially over-recovered from the heavy vehicle

fleet as a whole, due to an over-recovery from the smaller heavy vehicles.

However, changes in road expenditure (due to large increases over the last

couple of years) and road use from when the calculations were done indicate that

across the fleet as a whole, full recovery is now taking place.

The assessment of costs and benefits of the options has been undertaken in two ways. The first examines the results if each approach had been applied to vehicle charges since 1989. The second projects heavy vehicle charges under anticipated trends for road expenditure and road use by various classes of vehicles.

The Advisory Group undertook an assessment of identified options, which are

explained below.

Full recalculation (Option A) involves complex

calculations which, although fully reflective of changes in road use and

expenditure (factors influencing a Charges Determination), do not necessarily

meet all the objectives of an annual adjustment procedure. In particular,

objectives of simplicity are not well met, and implications on total revenue

raised are difficult to predict. Option A automatically links adjustment of

charges to changes in road expenditure and road use by areas, and thus is likely

to provide better achievement of remote area objectives, if differential charges

by area or vehicle type are adopted.

The adjustment formula approach

(Option B) provides a simple calculation which tracks changes in road

expenditure and expected changes in road use. This approach can be expected to

provide good outcomes for all objectives. Option B also has potential to better

link charges to changes in road expenditure and use by location, and thus could

be expected to meet remote area objectives well.

The expenditure index

approach (Option C) may be adversely affected by the fluctuations in road

expenditure, unless some form of moving average over a previous number of years

was adopted to smooth changes from year to year. However, the inclusion of a

moving average is not sufficient to ensure that the approach delivers efficient

and equitable outcomes, as it takes no account of changes in road use. This is

the fundamental difference between Option C and Option B.

The RCPI

approach performs well against objectives of raising revenue and simplicity

(as do all index based approaches). RCPI is heavily influenced by oil price, as

bitumen products and fuel are major road construction components and thus could

increase revenue too rapidly, and could also be subject to fluctuations

associated with oil prices.

The two CPI approaches perform well on

objectives of simplicity and raising revenue, but are more difficult to link

accurately to road use and road expenditure levels. Further, CPI has

historically fluctuated significantly at times and thus this approach could have

concerns on consistency and continuity objectives summarised in the efficiency

objective. Consequently, in presenting these options to Ministers, it was

proposed that an annual decision be made on whether to proceed with indexation

in that year.

All options could be further modified through the application

of “floor” and or “ceiling” provisions, setting maximum

and minimum levels for changes. However, the application of a

“ceiling” of the sort envisaged in the adjustment formula is not

relevant to indexation options as the proposed “ceiling” comprises

underlying inflation.

Table 3.1 Revised Option Assessment

|

Objectives |

A

Full Recalculation |

B

Adjustment Formula |

C

Expenditure Index |

D

RCPI |

E

CPI |

F

CPI minus X |

|

Revenue

|

?

|

|

|

|

|

|

|

Efficiency

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

Simplicity

|

|

|

|

|

|

|

|

Remote Areas

|

|

|

|

|

|

|

|

Overall

|

|

|

|

|

|

|

![]()

![]()

![]()

![]()

![]()

Best

Worst

From this initial assessment, Option B seemed the best of the options as

it provides the best match across the range of objectives considered important

for an annual adjustment mechanism. This view was supported in principle by the

Charges Advisory Group and most SCOT members. However, it was felt that further

analysis of the financial outcomes from applying these alternatives should be

examined and that Ministers should consider the two CPI-based indexation options

because of their simplicity.

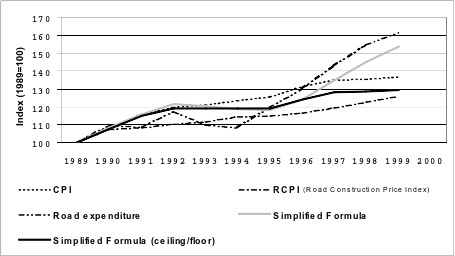

The graph in Figure 3.1

shows how heavy vehicle charges would have changed if they had been adjusted by

the possible adjustment procedures discussed above. Option F – Underlying

Inflation (ie compensating for GST impact on CPI) is not shown, as there are no

historic precedents. Option A (full recalculation) is also not shown because it

is impossible to predict how the basic assumptions used in the process might

have changed if reviewed annually.

Floors and ceilings could potentially be

applied to the expenditure option and therefore remove some of its

disadvantages. However, this still does not take account of changes in road use

that are fundamental to the Charging Principals set out in the Heavy Vehicle

Agreement. Floors and ceilings by their very nature are inapplicable to the

other approaches.

Figure 3.1 Historical Application of Possible Adjustment Mechanisms

Major implications and findings from this analysis are:

• In most

years, and especially since 1994, road expenditure has increased faster than

CPI.

• Applying the adjustment formula without a ceiling or floor (the

solid grey line), heavy vehicle charges would have risen faster than inflation

(because growth in road expenditure exceeded inflation), but slower than actual

road expenditure increases (due to the allowance for increasing road use). If

the expenditure on local roads had grown faster than on arterial roads,

increases in charges would have been less than inflation. This is because heavy

vehicles make much greater use of arterial roads, particularly rural arterial

roads.

• Without a ceiling and floor, the simplified method would have

yielded a slight reduction in charges in 1995, reflecting the fall in road

expenditure from 1992 to 1994, smoothed out by the use of the three year moving

average. If a floor were applied, charges would not have changed for these

years.

• If CPI were applied as a “ceiling” (the solid

black line) then heavy vehicle charges would have risen in line with inflation

for most of the 1990s, except for the 1992-1994 period when road expenditure

dropped.

• The road construction price index (RCPI) has generally

followed CPI except since 1997, probably due to real increases in oil prices (a

significant component of road expenditure is on bituminous products and

fuel).

The likely impact of applying the adjustment formula approach to adjusting

heavy vehicle charges in the future has been examined, based on two scenarios

that could be expected in the future from recent trends:

• road

expenditure is assumed to grow at 4.5% pa in Scenario 1 and 3.0% in Scenario

2;

• GDP is assumed to grow at 3% pa, with CPI at 2%

pa;

• heavy vehicle use is assumed to grow at 90% of GDP (i.e. 2.7%pa),

and light vehicle use at 70% of GDP (i.e. 2.1%pa);

• gradual

improvements in fuel consumption occur (vehicles are 1% more fuel-efficient each

year), reflecting observed trends; and

• the size of the heavy vehicle

fleet is assumed to grow 1% pa slower than vehicle use, reflecting the

increasing use per vehicle that is being observed.

In Scenario 1, where road

expenditure is assumed to grow by 4.5% pa, the adjustment formula would result

in greater increases than CPI unless a ceiling is included in the adjustment

procedure, as can be seen in Figure 3.2. A ceiling equivalent

to the underlying CPI was considered the most appropriate.

In Scenario 2,

where road expenditure is assumed to grow by 3% pa, incorporating a ceiling into

the adjustment formula would have no effect, as CPI is greater than the outcome

from the adjustment formula.

|

Scenario 1

(Road Expenditure Growth = 4.5%) |

Scenario 2

(Road Expenditure Growth = 3.0%) |

Figure 3.2 Future Impacts of Charges Adjustment Procedures

The adjustment formula adjusts for the effects of increasing road use, meaning heavy vehicle charges would rise more slowly than road expenditure, but the actual revenue from heavy vehicle charges would be preserved by the increase in numbers of vehicles.

Adjustments differ between rigid and articulated trucks using this

disaggregated approach for two reasons. First there are differences in their

patterns of use of arterial and local roads. Second, there are variations in

expected changes in vehicle use between the two groups of vehicles. That is,

there has been greater growth in larger trucks (articulated trucks, B-doubles

and road trains) than rigid trucks, and this trend is expected to continue.

An analysis was undertaken to examine separate formulae for three vehicle

groups:

• rigid trucks

• articulated trucks (single axle

semi-trailers)

• multi-trailer combinations (B-doubles and road

trains).

Differences between articulated trucks and multi-trailer

combinations were so small that separate results for these two categories are

not shown. Figure 3.3 shows

examples of applying different formulae to the two vehicle categories, compared

with a single formula for all heavy vehicles and CPI.

|

tAdjustment Formula

(No Floor or Ceiling) |

Adjustment Formula

(Floor of 0%, Ceiling of Underlying CPI) |

Figure 3.3 Examples of Differentiating by Vehicle Type Using Historical Data

Figure 3.3 shows that

if the adjustment procedure differentiates between types:

• rigid

vehicle charges would have risen more slowly than charges for articulated

trucks

• charges for articulated trucks would have risen slightly

faster than a single formula for all heavy vehicle types

• charges for

all heavy vehicle types would have risen more quickly than CPI in latter years

if there is no “ceiling” in the adjustment formula. When a

“ceiling” of CPI is applied, increases are very similar for all

heavy vehicle types.

Analysis suggests that the annual adjustment formula could result in

increases in annual registration charges of 0.5-1.0%, if road expenditure

increases by 2% per annum, or 3.5-4.0% if road expenditure increases by 5% per

annum. The precise result in any given year will depend on how road expenditure

is distributed between different road categories .

For the initial

adjustment, the NRTC obtained road expenditure data from road authorities. Data

was sought for the two most recent years of actual expenditure plus the current

budget year, but due to uncertainties with budgeted expenditure, the three most

recent years of actual expenditure was used. Similar data was obtained from

published sources for local roads. As there is no official published series for

underlying inflation, the NRTC obtained from the Australian Bureau of Statistics

a “constant tax rate measure” of the Consumer Price Index. This

series provides an estimate of underlying inflation, removing the effects of the

recent tax changes.

On the basis of the data supplied, application of the

agreed formula resulted in an initial adjustment factor of 5.56%. Underlying

inflation, for the four quarters to December 2000 compared to the four quarters

to December 1999, is 3.30%. The adjustment factor for heavy vehicle

registration charges, which was to apply from 1 October 2001, was therefore

3.30%. The relevant data and calculations are set out in the Annual Adjustment

Procedure for Heavy Vehicle Charges – Initial Adjustment: Regulatory

Impact Statement – July 2001 (Appendix E). The table below shows the

results of the 3.30% increase for the different vehicle types.

Table

3.2 Adjusted Initial Charges

|

DIVISION 1 - LOAD CARRYING VEHICLES

|

||||||||

|

Vehicle Type

|

2 axle

|

3 axle

|

4 axle

|

5 axle

|

||||

|

Trucks

|

|

|

|

|

||||

|

Truck (type 1)

|

310

|

620

|

930

|

930

|

||||

|

Truck (type 2)

|

516

|

826

|

2,066

|

2,066

|

||||

|

Short combination truck

|

568

|

2,066

|

2,066

|

2,066

|

||||

|

Medium combination truck

|

3,925

|

3,925

|

4,235

|

4,235

|

||||

|

Long combination truck

|

5,423

|

5,423

|

5,423

|

5,423

|

||||

|

Prime Movers

|

|

|

|

|

||||

|

Short combination prime mover

|

1,343

|

3,512

|

4,545

|

4,545

|

||||

|

B-double prime mover

|

4,132

|

5,165

|

5,681

|

5,681

|

||||

|

Road train prime mover

|

5,165

|

5,165

|

5,681

|

5,681

|

||||

|

DIVISION 2 - LOAD CARRYING TRAILERS

|

||||||||

|

The amount calculated using the formula:

|

$310 x Number of axles

|

|

||||||

|

DIVISION 3 - BUSES

|

||||||||

|

Bus Type

|

2 axle

|

3 axle

|

4 axle

|

|

||||

|

Bus (type 1)

|

310

|

|

|

|

||||

|

Bus (type 2)

|

516

|

1291

|

1291

|

|

||||

|

Articulated bus

|

|

516

|

516

|

|

||||

|

DIVISION 4 - SPECIAL PURPOSE VEHICLES

|

||||||||

|

Special purpose vehicle (type P)

|

No charge

|

|

|

|

||||

|

Special purpose vehicle (type T)

|

$207

|

|

|

|

||||

|

Special purpose vehicle (type O)

|

The amount calculated using the formula:

|

|||||||

|

|

$258 + $258 x Number of axles in excess of 2

|

|||||||

|

PERMIT FEES

|

||||||||

|

The charge for the grant of permit to operate a vehicle over 125 tonnes

carrying an indivisible

|

||||||||

|

load is to be calculated as:

|

|

|

|

|

||||

|

|

4 cents x ESA-km

|

|

|

|||||

Similar changes in charge levels are expected to occur when this same

procedure is applied automatically each year. Exact amounts can’t be

established at this stage as they will depend on changes in road expenditure and

CPI each year and in the future.

To put these adjusted changes in charges

into context as far as total operating costs are concerned, Appendix A shows

that the total operating costs of a 3-axle articulated truck is $321,000 per

year. An increase of $142 (see table above) is around 0.04% of these costs.

Similarly, the operating costs of a B-double are estimated at $479,000 per year.

An increase in charges of $225 is also around 0.05% of these total costs.

Therefore, any increase in charges is likely to have a negligible effect on

freight rates.

As mentioned above, there is no official published series

taking into account the impact caused by the introduction of the GST in 2000.

The “constant tax rate measure” of the CPI that the NRTC obtained

from the Australian Bureau of Statistics only applies up until the June 2001

quarter. From September 2001 the CPI quarterly figures published by the ABS are

no longer affected by the GST and can therefore be used in the annual adjustment

formula. However, the difference between the actual and the adjusted CPI figure

is not constant quarter to quarter. The NRTC has re-scaled the adjusted index

so that all future index numbers need no further adjustment.

Calculations for

the July 2002 annual adjustment formula results will therefore utilise two NRTC

“adjusted” index numbers for the March 2000 and June 2000 quarters.

Remaining index numbers used in the calculation and all future calculations will

rely solely on CPI figures published by the ABS.

The table below shows the

data that should be used for the first adjustment in July 2002 once the

Amendments to the Road Transport Charges (ACT) Act 1993 have been made.

Figures from the “NRTC (Adjusted)” and “ABS (Unofficial

Adjusted)” columns are to be used. Note that at this time not all of the

index numbers to be used for the July 2002 adjustment are available.

The

“NRTC (Adjusted)” column results in the same percentage changes in

CPI as the “ABS (Unofficial Adjusted)” column, as shown in the

calculations of year-on-year average percentage changes.

Table 3.3 Example of Index Numbers to be Used for the July 2002 Adjustment

|

|

|

CPI Levels (quarters)

|

Year average on year average percentage change

(%)

|

||||

|

Year

|

Quarter

|

ABS

|

ABS (Unofficial Adjusted)

|

NRTC (Adjusted)

|

ABS

|

ABS (Unofficial adjusted)

|

NRTC (Adjusted)

|

|

1999

|

March

|

121.8

|

121.8

|

124.6

|

na

|

na

|

na

|

|

|

June

|

122.3

|

122.3

|

125.1

|

na

|

na

|

na

|

|

|

September

|

123.4

|

123.4

|

126.2

|

na

|

na

|

na

|

|

|

December

|

124.1

|

124.1

|

126.9

|

na

|

na

|

na

|

|

Sum of 4 quarters

|

491.6

|

491.6

|

502.8

|

|

|

|

|

|

2000

|

March

|

125.2

|

125.2

|

128.0

|

na

|

na

|

na

|

|

|

June

|

126.2

|

126.2

|

129.1

|

2.4

|

2.4

|

2.4

|

|

|

September

|

130.9

|

128.0

|

130.9

|

3.5

|

2.9

|

2.9

|

|

|

December

|

131.3

|

128.4

|

131.3

|

4.5

|

3.3

|

3.3

|

|

Sum of 4 quarters

|

513.6

|

507.8

|

519.3

|

|

|

|

|

|

2001

|

March

|

132.7

|

129.8

|

132.7

|

5.3

|

3.5

|

3.5

|

|

|

June

|

133.8

|

130.8

|

133.8

|

6.0

|

3.6

|

3.6

|

|

|

September

|

na

|

na

|

na

|

na

|

na

|

na

|

|

|

December

|

na

|

na

|

na

|

na

|

na

|

na

|

|

Sum of 4 quarters

|

na

|

na

|

na

|

na

|

na

|

na

|

|

* Note: Figures for the September and December 2001 quarters are not yet

available. Figures shown in italics are adjusted.

The existing regulations affect all owners and operators of heavy vehicles (rigid trucks, articulated trucks, B-doubles, road trains, buses and special purpose vehicles) in Australia. Table 3.4 shows the approximate number of vehicles for which heavy vehicle charges apply, by state and vehicle type. The 345,000 vehicles shown above are owned and operated by a wide range of companies and individuals, with a high proportion of operators having only one or two vehicles in their fleet.

Table 3.4 Approximate Number of Vehicles Affected by Heavy Vehicle Charges

|

|

State of Registration

|

|

|||||||

|

Vehicles over 4.5 tonnes

|

NSW

|

VIC

|

QLD

|

SA

|

WA

|

TAS

|

NT

|

ACT

|

Total

|

|

Rigid trucks

|

73 100

|

61 600

|

48 000

|

24 600

|

38 900

|

8 100

|

2 900

|

1 700

|

258 900

|

|

Articulated trucks

|

12 800

|

13 400

|

9 600

|

4 400

|

4 500

|

1 400

|

200

|

200

|

46 500

|

|

B-doubles

|

500

|

500

|

800

|

400

|

500

|

0

|

0

|

0

|

2 700

|

|

Road trains

|

400

|

0

|

1 700

|

400

|

2 100

|

0

|

500

|

0

|

5 100

|

|

Buses

|

9 700

|

2 000

|

3 700

|

2 400

|

3 200

|

1 100

|

500

|

100

|

22 700

|

|

Special purpose vehicles

|

600

|

3 300

|

1 600

|

1 200

|

1 400

|

600

|

100

|

100

|

8 900

|

|

TOTAL

|

97 100

|

80 800

|

65 400

|

33 400

|

50 600

|

11 200

|

4 200

|

2 100

|

344 800

|

Source: NRTC Heavy Vehicle Cost Allocation Model (estimated 1997 data)

The initial consultation approach adopted consisted of:

• Convening

the Heavy Vehicle Charges Advisory Group, with representatives from road

authorities, the road transport industry and specialist advisors, to discuss and

advise on developing an annual adjustment procedure for heavy vehicles charges

as requested by ATC;

• preparation of a briefing note, listing the

potential options and issues associated with each one;

• holding a

teleconference with members of the Standing Committee on Transport (SCOT) to

review the options in the briefing note and agree a way

forward;

• undertaking further research investigating issues raised at

the SCOT teleconference and preparing a second briefing

note;

• individual discussions with representatives and members of the

Advisory Group and SCOT;

• discussion at meeting of Transport Agency

Chief Executives and SCOT;

• establishment of the preferred adjustment

procedure;

• preparation of this RIS;

• teleconferences with

representative directors of road transport associations throughout Australia as

well as the Remote Areas Group; and

• distribution of a discussion

document that identified the project objectives, potential options and impacts

of the suggested approach.

In June 2001, calculations for the adjustment

factor, the adjusted charges, and draft Road Transport Charges (ACT) Amendment

Regulations 2001 were distributed to TACE Members, TACE Observers, executive

directors of road transport associations, jurisdictional contacts and several

National Farmer’s Federation members for comment. No major concerns were

raised.

Discussions with the Heavy Vehicle Charges Advisory Group formed the basis

for the development of the suggested approach.

SCOT gave broad endorsement of

the suggested approach and the assessment of the options (although refined

changes were made). There were concerns that the suggested approach is more

complex than a simple indexation mechanism and examples were requested. These

were provided in the form of the analyses that are included in this

report.

Throughout industry consultations, concerns were raised regarding the

integrity and transparency of the suggested approach. In the views expressed,

it was indicated that for the adjustment process to have integrity, it must be

consistent with the principals of the 2nd Determination - this means

it must be linked in some way to road use and expenditure changes. For the

process to be transparent, it must be readily understood and the way in which

the process is applied and the data used should be able to be scrutinised.

There was general consensus that the approach being proposed is consistent with

these requirements. It was expressed that any increase in transport costs, no

matter what size, was an issue for some heavy vehicle operators in the current

environment.

A strong view was expressed from some industry representatives

that if adjustments were to be made, linkage with changes in road expenditure

and road use were preferable to indexation based on CPI.

Following the

distribution of documents explaining the adjustment factor along with related

calculations, the Commission received only 2 replies expressing concerns over

the adjustments to heavy vehicle registration charges. These concerns related

to the:

• Proposed timing

Initially it was proposed that the

annual adjustment apply from 1 July 2001, however the date of 1 October 2001

emerged from the ATC discussion, based on the Commission’s advice as the

earliest possible date for achieving the necessary changes in the template

legislation. This means that the initial adjustment is in fact 3 months behind.

All of the jurisdictions have a target date of July 2002 for the next adjustment

and subsequent adjustments would be implemented on July each year up to the

implementation of the 3rd Determination.

• Absence of any

reference to the fundamental review of heavy vehicle charges

The

ATC’s decision on annual adjustments was predicated on the advice that a

3rd Determination (a full review of heavy vehicle charges) would be

implemented in 2004.

• “Ceiling” and “floor”

approach

Ministers indicated that they wished to consider a proposal to

remove the ceiling from the formula when they meet in November 2001. Decisions

regarding the floor were to be clarified at this time.

•

“Automatic” characterisation

Given the timing of the next

fundamental review of the 3rd Determination, it is impractical to

expect any annual adjustment process other than an agreed formula (which is in

fact a simplified version of the process applied in the 2nd

Determination) in the intervening years.

• NRTC’s

role

The Commission has fulfilled a key role in the development of an

annual adjustment that maintains integrity and transparency.

The regulation impact assessment process adopted identified six major charge

adjustment procedure options, which were further modified through the additional

concepts of “ceiling” and “floor” levels to changes in

charge levels.

These options were assessed against five regulatory

objectives. A preliminary assessment was undertaken, which was then revised in

light of further research and investigation undertaken in response to issues

raised during earlier stages of the consultation process.

The recommendation from NRTC, following the Annual Adjustment Procedure for

Heavy Vehicle Charges regulatory impact assessment process was for

the:

Establishment of an annual adjustment procedure for heavy vehicle

charges related to changes in road expenditure, corrected for expected changes

in road use and heavy vehicle fleet size, and incorporating a

“floor” of 0 per cent and a “ceiling” of the underlying

growth in the Australian Consumer Price Index.

Option B, the adjustment

formula with a ceiling and floor, was preferred on the basis that it performs

best overall against the objectives, compared to other available options.

The disadvantages of the rejected options include the

following:

• Option A, full recalculation, requires complex

calculation and does not meet the objectives of simplicity and ease of

explanation to owners and operators of heavy vehicles. Further, this approach

would require significant consultation, research and analysis on an annual

basis. The NRTC would not be able to do this without significant funding

increases, and consultation indicates that doubtful value would be achieved from

this approach.

• Option C, the road expenditure index, would be

adversely affected in application by fluctuations in road construction

expenditure across the years, and also in perception due to widely differing

expenditure in different areas and on different road types. Further, this

method takes no account of road use, nor of changes in vehicle numbers or

average loadings.

• Option D, Road Construction Price Index

(RCPI), is influenced by oil price, and so may show greater fluctuations than

desirable in an index for adjusting heavy vehicle charges. This also does not

take into account the various road use factors.

• Options E and

F, CPI and Underlying Inflation, while widely understood and recognised,

suffer from the lack of alignment between road expenditure and CPI, and the fact

that both RCPI and road expenditure have been increasing much more quickly than

CPI for most of the last decade. The idea of a factor taking into account GST

impacts may also have an adverse perception of allowing indiscriminate

adjustment to suit unspecified purposes.

• Option G, this would

not be consistent with the objectives outlined in Section 1.2, in particular those

associated with equity, efficiency and providing revenue streams to match

resource requirements.

The adjustment formula was developed by NRTC, in conjunction with SCOT, in

response to a request by Ministers at the November 2000 meeting of ATC. At that

meeting, Ministers also stated that indexation of registration charges on the

basis of underlying CPI would be considered as a fall-back position in the event

that there was no agreement on the adjustment formula. Chief Executives of

Transport Agencies at the TACE and SCOT meetings in April 2001 also requested

that adjustment on the basis of full CPI be included as an option.

The three

options are:

(i) Simplified Charges Adjustment Formula

(ii) Underlying

Inflation

(iii) Consumer Price Index

Option (i), if implemented operates

automatically, however options (ii) and (iii) are subject to the approval each

year of Ministers through a voting process to ensure the changes in charges are

consistent with the charging processes.

At the meeting of Australian Transport Council on 25 May 2001, it was agreed

that heavy vehicle registration charges would be adjusted annually by the

adjustment formula.

It was further agreed that the initial application of

the formula would be scheduled to take place as close as possible to 1 October

2001, and that this would include a ceiling of underlying inflation (CPI

adjusted to remove the impact of changes to the tax system). Ministers also

agreed that future adjustments would occur annually, on 1 July each year.

The initial adjustment to the heavy vehicle registration charges was made by

means of an amendment to the Road Transport Charges (Australian Capital

Territory) Regulations 1995, and was to commence on 1 October 2001. These

amendments were made under section 4 of the Road Transport Charges

(Australian Capital Territory) Act 1993, which provides for a

regulation-making power for annual variations of up to 5% in the level of

charges. It is no longer appropriate to use this approach to implement the new

agreed automatic annual adjustment procedure for two reasons:

1. the power

limits adjustments to a maximum of 5%, while the agreed formula may result in

larger adjustments (the initial adjustment was 3.3%); and

2. the approach

does not allow the adjustment procedure to be automatically applied each year.

Instead, regulations would need to be drafted and approved by the ATC in

accordance with the National Road Transport Commission Act and made in the

Commonwealth Parliament each year.

Amendments to the Road Transport

Charges (Australian Capital Territory) Act 1993, will ensure that

adjustments to heavy vehicle charges occur automatically each year from July

2002 in accordance with the agreed formula.

Vehicle registration charges are accepted as a fact of life by heavy vehicle

operators, and represent a small proportion (typically less than 2 per cent) of

total heavy vehicle operating costs. Two typical vehicle cost models, one for

six-axle semi trailers and the other for B-double combinations, are shown in

Appendix A to illustrate this.

Compliance with existing requirements is very

high and enforcement requirements are very low. It is anticipated that the

annual adjustment procedure would increase the perception of equity, efficiency

and simplicity of heavy vehicle charges among owners and operators of such

vehicles, while increasing total revenue.

Amendments to the Road Transport Charges (ACT) Act 1993 will provide

for the adjustment procedure to be applied as of 1 July each year. Commencement

of the amendments is timed to ensure the automatic annual adjustment procedure

is first applied from 1 July 2002. The legislation provides for the results to

the adjustment to be published officially by the NRTC.

The NRTC proposes to

distribute details of the data and calculations publicly for comment to ensure

there is no uncertainty over the figures to be used. Each step of the

calculations will be detailed, as will the final results. Individual

registration authorities will also advise operators of heavy vehicles of the

applicable changes by means of renewal notices.

It is intended that the annual adjustment procedure for heavy vehicle charges

be an automatic process. However, as road expenditure information used in the

application of the formula is not available in advance, it can not be included

in legislation ahead of time. This means that the information used to apply the

formula will not be considered directly by the Commonwealth Parliament as each

adjustment occurs. Nevertheless, there are checks and balances in this process

and every effort is being made to make it as transparent as possible.

The

NRTC will publish all expenditure data used in the application of the annual

adjustment procedure each year. In the first year this will be done by means of

a special bulletin, and thereafter in the Commission’s Annual Report which

is tabled in each Parliament.

The ceiling presently included in the annual

adjustment formula provides a check on the maximum amount by which charges can

increase. This ceiling is based on the CPI, which is frequently used for

automatic indexing of taxes and charges. Inclusion of this ceiling means that

if the expenditure data published by the NRTC results in large increases in

heavy vehicle charges under the formula, these increases would not apply as the

ceiling would come into play. Similarly, if there is a sudden decrease

following an unusual increase in expenditure, the floor provides a check against

decreases in charges that could be expected to increase again in the following

year.

The annual adjustment procedure is intended to update the 2nd

Heavy Vehicle Charges Determination. It is intended to apply as an adjustment

mechanism until the 3rd Determination is implemented. The

3rd Determination is scheduled to be completed at the end of 2003 as

part of the NRTC’s agreed Strategic Plan. The 3rd

Determination would be expected to be implemented in July 2004.

The

3rd Determination will fully review charges applying to heavy

vehicles for the costs of providing and maintaining roads. At the same time,

any adjustment process to apply following the 3rd Determination up to

the point of a future Determination will be considered.

It is submitted that the changes in the method of adjusting heavy charges are

fully compliant with National Competition Policy.

No aspect of the changes

restricts competition between participants and potential entrants to any

market.

Truck Cost Model Comparison

Based On Conventional

Tautliner Trailer(s) With Air Suspension

|

|

Tri-Axle Trailer

|

|

B-double

|

|

Comments / sources

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

25 tonne payload

|

|

42 tonne payload

|

|

|

||||||||||

|

|

Cost ($)

|

Proportion of Total (%)

|

Cost ($)

|

Proportion of Total (%)

|

|

||||||||||

|

Fixed Costs

|

|

|

|

|

|

||||||||||

|

Finance

|

|

|

|

|

|

||||||||||

|

- Prime mover

|

44 677

|

13.94

|

51 060

|

10.67

|

|

||||||||||

|

- Trailer

|

14 324

|

4.47

|

28 647

|

5.98

|

|

||||||||||

|

Insurance @ 3%

|

8 460

|

2.64

|

11 520

|

2.41

|

|

||||||||||

|

Registration

|

4 300

|

1.34

|

6 800

|

1.42

|

VicRoads telephone enquiry 1/5/2001

|

||||||||||

|

TAC

|

1 322

|

0.41

|

1 322

|

0.28

|

TAC in Vic only, but equivalent charges other jurisdictions

|

||||||||||

|

Administration

|

5 500

|

1.72

|

5 500

|

1.15

|

|

||||||||||

|

Vehicle eqmnt/ Sundries

|

2 000

|

0.62

|

3 000

|

0.63

|

|

||||||||||

|

Total fixed costs

|

80 583

|

25.13

|

107 850

|

22.53

|

|

||||||||||

|

Variable Costs

|

|

|

|

|

|

||||||||||

|

Fuel

|

78 545

|

24.50

|

130 909

|

27.34

|

|

||||||||||

|

Lubricants at 5%

|

3 927

|

1.22

|

6 545

|

1.37

|

Industry standard

|

||||||||||

|

Tyres (per axle)

|

10 800

|

3.37

|

27 000

|

5.64

|

Industry standard

|

||||||||||

|

Maintenance

|

19 800

|

6.18

|

33 000

|

6.89

|

Industry standard

|

||||||||||

|

Total variable costs

|

113 072

|

35.27

|

197 454

|

41.24

|

|

||||||||||

|

Labour costs

|

|

|

|

|

|

||||||||||

|

Drivers wages including oncosts

|

93 401

|

29.13

|

123 535

|

25.80

|

|

||||||||||

|

Relief driver allowance

|

4 000

|

1.25

|

6 000

|

1.25

|

|

||||||||||

|

Uniform

|

400

|

0.12

|

400

|

0.08

|

|

||||||||||

|

Total labour costs

|

97 801

|

30.51

|

129 935

|

27.14

|

|

||||||||||

|

Sub Total cost

|

291 457

|

90.91

|

435 238

|

90.91

|

|

||||||||||

|

Profit margin @ 10%

|

29 146

|

9.09

|

43 524

|

9.09

|

|

||||||||||

|

TOTAL

|

320 603

|

100

|

$478 762

|

100%

|

|

||||||||||

|

Cost per kilometre

|

1.78

|

|

$1.59

|

|

|

||||||||||

|

Assumptions

|

|||||||||||||||

|

Operating days per annum

|

250

|

|

300

|

|

Industry standards

|

||||||||||

|

Kilometres pa

|

180 000

|

|

300 000

|

|

Typical for interstate linehaul vehicles, first 5 years of use

|

||||||||||

|

Capital required

|

|

|

|

|

|

||||||||||

|

Equipment

|

|

|

|

|

|

||||||||||

|

- Prime mover

|

$210 000

|

|

$240 000

|

|

Typical specification International, Ford, Scania, Volvo

|

||||||||||

|

- Trailer(s)

|

$72 000

|

|

$144 000

|

|

Typical 48' tautliner

|

||||||||||

|

Total axles

|

6

|

|

9

|

|

|

||||||||||

|

Interest rate

|

7.95%

|

|

7.95%

|

|

|

||||||||||

|

Term of lease

|

|

|

|

|

|

||||||||||

|

- Prime mover

|

4 years

|

|

4 years

|

|

Major transport company standard

|

||||||||||

|

- Trailer(s)

|

5 years

|

|

5 years

|

|

Major transport company standard

|

||||||||||

|

Residual

|

|

|

|

|

|

||||||||||

|

- Prime mover

|

40%

|

|

40%

|

|

Typical lease arrangement

|

||||||||||

|

- Trailer(s)

|

30%

|

|

30%

|

|

Typical lease arrangement

|

||||||||||

|

Diesel price

|

$0.72

|

|

$0.72

|

|

With ANTS rebate

|

||||||||||

|

Kilometres per litre

|

1.75

|

|

1.45

|

|

Typical fuel consumption - interstate operations

|

||||||||||

|

Litres per 100 km

|

57.1

|

|

69.0

|

|

Typical fuel consumption - interstate operations

|

||||||||||

"Source: Sinclair Knight Merz Logistics Group industry inquiries, March

2001. Registration charges from Vicroads."

|

ABS

|

Australian Bureau of Statistics

|

|

ATC

|

Australian Transport Council

|

|

ATS

|

Australian Transport Secretariat

|

|

COAG

|

Council of Australian Governments

|

|

CPI

|

Consumer Price Index

|

|

GST

|

Goods and Services Tax

|

|

NRTC

|

National Road Transport Commission

|

|

ORR

|

Commonwealth Office of Regulation Review

|

|

RCPI

|

Road Construction Price Index

|

|

RIA

|

Regulatory Impact Assessment

|

|

RIS

|

Regulatory Impact Statement

|

|

SCOT

|

Standing Committee on Transport

|

|

TACE

|

Transport Agency Chief Executives

|

Participants at Annual Adjustment of Heavy Vehicle Charges Advisory Group

Meeting – 5 February, 2001.

Barry Moore NRTC

Fiona

Calvert NRTC

Kerry Todero NRTC

Dick Bullock Bullpin Pty Ltd

William McDougall Sinclair Knight Merz

Tony Boyd VicRoads

Bruce

Chipperfield Vicroads

David Coonan Department of Urban Services

ACT

Phillip Cross Department of Transport & Works NT

Robert

Gunning Australian Trucking Association

Philip Halton Queensland

Transport

David Hill Australasian Railways Association

Robert

Hogan Department of Transport & Regional Services

Tim Martin ARRB

Transport Research Ltd

John Metcalfe Australian Automobile

Association

Bob Peters Main Roads WA

Carl Ricks Queensland

Transport

Peter Rufford Australian Local Govt Association

Chris

Walker NSW Roads and Traffic Authority

Anne Westley Transport SA

Summary of Comments in response to the draft Annual Adjustment Procedure for Heavy Vehicle Charges – Initial Adjustment: Regulatory Impact Statement July 2001

|

ORGANISATION

|

ISSUE

|

COMMENTS

|

|---|---|---|

|

ALTA & ATA

|

The Interim Adjustment must be seen in context

|

In the view of the ATA, it is vital that the interim adjustment process

represented by the current proposal is seen in context. In particular, it

should be seen as providing an interim adjustment between more fundamental

reviews of the cost recovery process and national truck registration

charges.

|

|

ALTA & ATA

|

Interim Adjustment Recommendation

|

The paper must make it clear that a two-stage charge review process is

recommended; namely:

• interim adjustments as mapped out; and • fundamental reviews which open up all areas for examination. |

|

ALTA & ATA

|

Integrity

|

It is of fundamental importance that the integrity of the cost recovery

process by maintained and enhanced.

|

|

ALTA & ATA

|

Public and Industry Confidence

|

Public and industry confidence in the cost recovery program can only be

maintained if the charges determination process is subject to full public

scrutiny.

|

|

ALTA & ATA

|

A Particular Proposal

|

The view of the ATA and its member organisations will take into regard any

particular recommendations for a change in national truck registration charges

depending on:

• The way in which the policy framework is implemented; and • Prevailing circumstances at the time. |

|

ALTA & ATA

|

Proposed Interim Adjustment

|

With the caveats noted above, the ATA accepts the interim adjustment

process as outlined.

|

|

Department of Urban Services (ACT)

|

|

No comments to make on, or concerns with the draft RIS.

|

|

NSW RTA

|

Indexation based on road expenditure

|

The NRTC’s proposed method of indexation based on the level of road

expenditure is too complex.

|

|

NSW RTA

|

Indexation based on the CPI

|

• Indexation based on the CPI is conceptually simple, is used in

other sectors of the economy for purposes of indexation and is more readily

understood by the general public.

• CPI indexation is likely to yield similar results as the proposed formula, particularly if it is ‘capped’ to the rate of CPI. • If CPI indexation were adopted, no amendment to model legislation would be required. • For NSW and any other jurisdiction that has adopted the legislation, the introduction of CPI based indexation on heavy vehicle charges could be implemented at relatively short notice. |

|

Department of Infrastructure, Energy & Resources (Tas)

|

Section 3.3 - Figure 3.1

|

This would be more effective if the current charges were included.

|

|

Department of Infrastructure, Energy & Resources (Tas)

|

Section 3.4

|

Although the draft RIS was prepared prior to the release of the second

quarter figures for 2000-01, the assumed GDP and CPI now seem to be inaccurate.

It is understood that Australia has experienced negative GDP in the last two

quarters, which is expected to continue for the third quarter.

|