|

Home

| Databases

| WorldLII

| Search

| Feedback

Upholding the Australian Constitution: The Samuel Griffith Society Proceedings |

5

A Federalist Agenda for Coast to Coast Liberal (or Labor) Governments

The Honourable Richard Court

This is the first time in the history of The Samuel Griffith Society that two former treasurers of Western Australia have led critical discussion on our federation.

Some may be expecting a team act that presents a strong case for the secession of Western Australia from the federation – to the contrary, I see it as our responsibility as members of The Samuel Griffith Society to strengthen the federation with constructive, well-thought through arguments supporting the necessary changes required to reverse this constant trend of centralising more and more revenue streams and other critical powers into Canberra.

What is more, the reality is secession has already occurred. The central government in Canberra has seceded from the federation of States! Successive central governments of both major political persuasions have lost touch with the States and lost interest in understanding the challenges different States face in delivering the majority of this country’s essential services without the revenue autonomy required.

It is demeaning for State leaders and State bureaucrats to be lectured by their federal counterparts on how to run schools, hospitals, power systems, environmental approvals, infrastructure priorities, etc, when they themselves have trouble putting two submarines to sea at the same time.

Canberra’s transformation to the political equivalent of a schoolyard bully has happened because successive central governments – Liberal and Labor – have used their growing financial muscle and interpretations of our Constitution by the High Court to erode the position of the States.

In my youth it was the Whitlam Government who, I vividly remember, wanted to override the States on many fronts including their Soviet-style plans to take control of our gas at the well head. The transformation of Canberra from the capital of our federation to Australia’s answer to the hermit kingdom has been sustained and relentless.

The Howard-Costello Government in its latter years was antagonistic towards the States, using the excuse that all the States were governed by Labor and why would you want to give them any more money – they are not competent. This blinkered and arrogant view has one serious flaw. The decision as to who elects the State governments is made by the people of each State. If they believe the government needs to be changed, they will change it. However, the Government in Canberra needs to work with all the States, whatever their political persuasion.

The Rudd-Gillard governments then tried the nuclear bomb approach – a resource super profits tax to try to override royalty revenue streams of the States. After a violent reaction across the political divide it morphed into the mining resource rent tax (MRRT) but still with a foot in the door to weaken further the States’ ability to raise revenues.

The announcement of the RSPT achieved many things including:

● Putting sovereign risk on the table for investors and customers.

● Focusing Tony Abbott’s attention on the financial plight of the States. In Western Australia he even vows to be a “born again federalist” which is a positive break from his natural tendency to follow in John Howard’s footsteps.

Hopefully this empathy for the long-term financial decline of the States will rub off on to some of his “experienced” front bench who still delight in lecturing the States.

I repeat the story that my father fondly recalls Sir Robert Menzies saying in the Cabinet ante-room after a fiery and contentious Premiers’ Conference and Loan Council: “Six State premiers send me up the wall but I would not have it any other way because it is our insurance against dictatorship”.

The Canberra money grab has to stop. Both the major political parties must reassess the imbalance between the revenues collected by the different arms of government and the areas of expenditure for which they have responsibility. Putting it bluntly, we are one of the few countries in the world where the central government actually has too much money and they resort to incredibly inefficient ways to spend that money – more of that a little later.

As I have said, this Sheriff of Nottingham mentality knows no political boundaries. We expect a drift to the centre from Labor governments but, in the past, both the major political parties have followed the same path. If the government changes at the 2013 federal election, does that mean the attitude towards the States will change? Bad habits are hard to fix but, if the former Howard-Costello Government ministers who were dismissive of the States are a part of an incoming ministry, and believe they can simply continue where they last left off, they will face a massive backlash within the State branches of the party.

Historically

As we look at attitudes and actions of the present, it is perhaps illuminating to consider the views and concerns expressed by the different State representatives who spent the best part of a decade negotiating the Constitution for our federation during the 1890s. What were their intentions?

In Western Australia’s case, the lead player was our first Premier, John Forrest. Forrest wanted the States to have a fiscal freedom . . . financial independence and, as the eventual model emerged, he warned that the path chosen would lead to power being centralised in the new Federal Parliament, but even he could not imagine the speed with which the States’ position was eroded. John Forrest said:

All we desire to say is that three fourths of the Customs revenue shall be returned to the States. Unless the States have some security of this kind the people cannot be expected to accept the Constitutional bill . . . It is like beating the air to tell us that we are to give up our great revenue producer – the Customs – and that we are to have no guarantee whatever that any part of that money will be returned to us, although we shall each have to provide for the payment of interest on our public debts.

Well, within a decade the Commonwealth Parliament had abolished these obligations and it is no surprise that, 110 years later, a new beast called the Resource Super Profit Tax was unleashed as yet another attempt to grab a revenue stream quite rightly belonging to the States. As an aside, just to show how young our federation is, my father, Sir Charles Court, who passed away a few years ago at the age of 96, was alive with all of the premiers of Western Australia, including the first, John Forrest, and the current premier, Colin Barnett.

Over the years we have seen countless interpretations of the Commonwealth Constitution by the High Court giving the Commonwealth Parliament legislative powers wider rather than narrower scope and meaning. Our constitutional history is littered with examples of a little give and a lot of take by Canberra. It is an attitude that has fuelled repeated talk of secession in the west and, in one case, direct action. In the secession referendum in Western Australia, held on 8 April 1933, there was a two-to-one majority vote in favour of Western Australia seceding from the Commonwealth. The response to the discontent was establishment of the Commonwealth Grants Commission to assist in a fairer distribution of revenues between the States.

During the Second World War we then saw the central government temporarily take over income taxing powers. When peace returned, the States income tax did not.

It is correct that the States can still constitutionally raise an income tax. But the political reality is that, unless the central government is prepared to lower its rates to allow the States to have a share, it will be difficult to achieve.

We saw a central government introduce a payroll tax which was then transferred to the States in 1971. We saw the High Court decision which ruled that the States could not raise license fees for wholesaler’s licenses covering areas like tobacco and alcohol. The Federal Government needed to step in to collect these taxes on behalf of the States.

In many ways this was the catalyst in 1998 when the Howard Government introduced legislation for the goods and services tax (GST). To the credit of the Howard-Costello Government, this was a taxation proposal put fairly and squarely in front of the people before an election, giving it legitimacy when it was introduced.

Christian Porter has clearly outlined the issues surrounding the GST but I want to make this observation. When the GST was introduced, there were projections made as to what the collections and distributions would be between the States; at the same time there were projections for the Federal Government’s collection of income tax and company tax.

Peter Costello as the Federal Treasurer had a standard speech that he would present to all the States, hammering them by saying, “we are giving you access to a growth tax, it has grown quicker than we projected, what are you doing with all the money?”

It was correct that the GST was providing a growth revenue source, but what he failed also to say is that income tax and company tax collections were also growing at record levels courtesy of the first wave of very strong commodity prices in the latter half of their term in government.

It is much easier being a treasurer in Australia when commodity prices are strong. For many years, the revenues flowed in well above Treasury predictions. To his credit Costello used these revenue streams to retire debt and address the central government’s superannuation liabilities.

Wayne Swan, Treasurer in Labor governments, 2007 to 2013, has had even stronger commodity prices filling the Treasury coffers. In that environment there is no excuse for the central government not to be running substantial surpluses.

Yes, confidence needed to be enhanced during the Global Financial Crisis but our strong export performance hardly missed a beat. The central government has the strong financial muscle due to the fact that it collects the company taxes and income taxes and we all know the old rule – whoever has the money tends to call the shots.

Today it is a different story: GST revenues are not growing as projected. Western Australia is heading towards a zero per cent share – that is what I call heavy lifting and enough to cause real unrest.

The irony of the workings of the Commonwealth Grants Commission is that it can reward inefficient States. If a State discourages mining, fishing or a timber industry, it can have wonderful green credentials and receive an even greater share of revenues generated by States like Queensland and Western Australia!

We just had one of the wise men from the east, Joe Hockey, the Shadow Treasurer, saying it was time for Western Australians now do some “heavy lifting” to help the other States that are struggling – no problems with that. We have been beneficiaries in the past.

Speaking of heavy lifting, when a State with 10 percent of Australia’s population produces 40 percent of Australia’s total export income, that is heavy lifting and it requires massive infrastructure expenditure and delivery of expensive health, education and other services in remote regions. If in doubt, visit or, better still, work inside these projects to experience the challenges.

He went on to give us some advice that we should introduce toll roads as a solution to the State’s financial problems – that is, more tax. We already tax fuel. The more fuel you use, the more tax you pay. In our books, that is a fair user pays system.

Fuel taxes, or different variations of it, were introduced to fund roads. We are still collecting tax on fuel but they seemed to have been lost into general revenue.

Western Australia does not have toll roads for good reason. The people using those roads, cars, trucks, etc, already have user pay taxes to fund those roads. Toll roads are double dipping as if a fuel tax never existed.

Next we are going to be told to put poker machines in all the clubs and hotels to raise more money. I can assure you that no government of either political persuasion in Western Australia will ever go down that path.

When Joe Hockey made these comments he reminded me of my first meeting, as a new young State MP, with the CEO of the then Bank of New South Wales in Sydney in the early 1980s. He bluntly told me the States were a nuisance – there is only one worth keeping and that is New South Wales.

I was too intimidated to reply that Western Australia was the only State that had never been a part of New South Wales and, perhaps, we should revert to those boundaries for our country.

Then along comes the Resource Super Profit Tax which morphed into the MRRT. As I have said previously, another back door attempt by the central government to put a bigger tap into the resource sector revenue vein at the expense of the States and the companies who have played such a responsible role in ensuring the continuing strength of the Australian economy, particularly during a difficult global financial crisis.

Why do you need a new tax? If commodity prices are high, companies are making record profits, well, guess what, companies pay record tax – company tax.

The Government receives record levels of income tax because of the high employment generated. If you feel so strongly that the company tax being paid is not enough, why do you not have the guts to raise the level of company tax.

There was one small hurdle with this initial proposal and that was we have sovereign States with the minerals in those States belonging to the Crown and it is the States’ constitutional responsibility to manage those resources properly. It is up to the States whether or not they charge an ad valorem royalty or a profit-based royalty and, if the royalty levels happen to be low, the Federal Government collects more in tax, and vice versa.

The good news about the MRRT is that the Liberal Opposition has agreed to scrap it along with the carbon tax which is actually working to increase global carbon dioxide emissions by seeing energy intensive mineral processing being transferred from Australia to countries using predominantly coal fired power generation with higher emissions.

Whenever the question of access by the States to revenue streams is raised there are always plenty of suggestions to increase the level of certain taxes – for example, increase the rate of GST. My answer is simple. We are already collecting enough taxes in this country. It is not the overall amount that is the issue, it is the effectiveness of how it is distributed and spent.

The federation will fracture unless there is a change of heart by the major political parties. My message to all the State premiers and the State Leaders of the Opposition is that Western Australia is your friend. We are fighting for all the States to have access to new growth revenue streams.

The split of GST revenues between the States is another important issue but the most critical one is regaining some financial autonomy.

I now put forward a constructive suggestion. Our central government is about to be swamped with a tidal wave of a massive growth revenue stream as a consequence of the current development of the next generation of offshore LNG projects, Gorgon, Ichthys, etc. What is not widely understood is that the North-West shelf LNG project, so far Australia’s largest and most successful resource project, even though it is in “Commonwealth waters”, has a royalty-sharing arrangement where approximately 70 per cent of the royalties flow to the government of Western Australia and 30 per cent to the central government.

It was an agreement negotiated between the State (by Sir Charles Court’s Government) and the Commonwealth (Malcolm Fraser’s Government). As a result of the workings of the Grants Commission, the majority of that 70 per cent flowing to Western Australia is then redistributed to all the other States and, as we are aware, Western Australia has been ending up with a smaller and smaller share as a result of that revenue redistribution.

But the bottom line is all the States benefit from this arrangement and that is why all the States should be very, very, very interested in the types of negotiations Western Australia is trying to do with our central government.

With the next generation of offshore LNG projects, for example, Gorgon, Ichthys, etc, not a single dollar of the royalty revenue stream will flow to the States, either to Western Australia or any other State. It will all go straight into the central coffers.

![]()

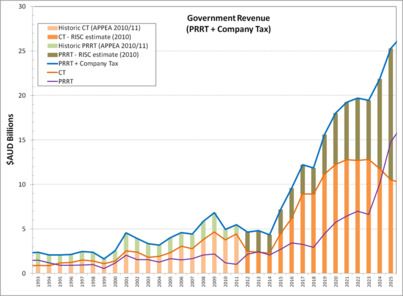

This graph shows that there are two beautiful hockey stick numbers coming through. The first is company tax about three years after a project like Gorgon goes into production. You see this massive kick in company tax and then, about ten years later, you see the second hockey stick occur. This is when the PRRT royalty stream starts flowing.

Once they have recovered all their expenditures related to those projects they then pay 40 percent to the government. My proposition is that the central government gives a commitment that it will share those new PRRT revenue streams from these offshore LNG projects 50/50 with the States and that 50 per cent be distributed simply on a per capita basis completely separately from the Grants Commission and with no strings attached as to how the States spend that money.

I repeat the North-West Shelf project is currently 70 per cent to the States and 30 per cent to the central government. I believe that a 50/50 split is fair, particularly considering that nearly immediately the Federal Government is going to have a massive kick in company tax collections.

If an incoming government made this commitment, it would be nearly 10 years into the future, but 10 years in the life of a nation goes very quickly and at least the States could be planning to have access to that new revenue stream as it eventuates.

Simple, Fair – I do not care which government does it. Just do it. The States should ignore pathetic brush offs that “we will allocate some of these revenues to infrastructure projects in your State”. This is meaningless compared to the certainty of sharing this new growth revenue stream.

That is enough on money. I am going to move to infrastructure.

Infrastructure

This is a “doosey”. The central government has bodies like Infrastructure Australia making recommendations on priorities for major projects. The States put in a wish list, recommendations go to the central government and the States are at their beck and call as to what is going to be supported.

Why do we elect State governments? We elect them to make these types of decisions within their States because they are the closest and know the best infrastructure requirements for that State. If they mess it up, change that State government.

This current approach is terribly inefficient. A short list is agreed to. There will always be priority changes to projects but State governments will not dare take them off the list for fear of losing money that may have been earmarked.

You have to have had experience in a State government to know how demeaning it is when told what strings the Federal Governments want to put on expenditure programs. In the months before a Federal election you will always get a call from the Treasurer in Canberra, if he is from your party, saying, look, we want to spend a few million on a new highway, how about working with us and we will go 50/50 putting this highway through some marginal seat.

As if you can design and build a highway in a few months, but they think they win political points by saying we are announcing that you are going to do that particular highway. The fact that they have ignored your request for several years to build that or another road is just brushed aside in a telephone call.

Both the major political parties operate that way.

To divert attention on money issues at a Premiers’ Conference, prime ministers use the old trick of throwing $100 million on the table for one of their pet projects and then sit back and watch the States fight for a share – it is a cheap trick.

The bottom line is that the States should already have autonomy with their revenue streams not to require the central government to fund all but nationally critical infrastructure projects. There will always be a need for some special projects to occur but it has now got down to often relatively small amounts of money.

So, on the infrastructure front, if the States have access to stronger revenue streams, you do not need to have as much involvement of the central government in trying to pick winners as to what is going to be built.

Industrial relations

What a debacle! The Howard Government did what the Whitlam Government could only have dreamed of – it used the corporations power to centralise industrial relations power in Canberra, along with the support of our business leaders at the time.

I was a strong supporter of the direction in which the Howard Government’s industrial relations legislation was heading. It reflected what we had already successfully implemented in Western Australia following a series of industrial relations legislative changes commencing in 1993.

To use the corporations power, however, to override the State systems in relation to companies was a major mistake. I opposed this move even though, by then, I had left the political arena.

John Howard, when he was the Opposition’s industrial relations spokesperson in 1992, made it clear to us in Western Australia before we went to the polls in 1993 that the federal party was going to go down that path and we argued strongly to the contrary. Why?

In the industrial relations world you need “relief valves”. You need flexibility. There is an old saying: there are no winners in industrial relations – only survivors.

In 1993 we introduced the first of our industrial relations legislative changes supporting the deregulation of the labour markets allowing for individual workplace agreements and the like. By Christmas 1993, less than 12 months after being elected, Conzinc Rio Tinto was transferring their workforce to these new arrangements.

Within a few years the Pilbara was transformed with workers being paid more, having more flexibility in their work place, improved work conditions, very few disputes and the unions were closing their Pilbara offices. All this occurred while Paul Keating was a Labor prime minister and was carried out under a State industrial relations regime. You could move between State and federal jurisdictions.

Hawke and Keating themselves controlled unions during some difficult economic times with their personal authority within the union movement – that is not easy. They still, however, supported a highly centralised system.

We were able to achieve change in Western Australia by having a different system to that federally.

That avenue has now been removed and the business community is equally to blame. When I discussed this with business leaders at the time I was told, bluntly, get off your old “states’ rights” horse – no future government would dare go back to the bad old days.

My response was they will do it within 20 seconds of being elected, and they have. But this time there is no relief valve. There are no options.

This legislation was challenged by the States but, being Labor States at the time, you can imagine how much heart and soul they put into this challenge. As one of the High Court judges noted, “the power of the Commonwealth with respect to industrial affairs is a power in relation to ‘conciliation and arbitration’ for the prevention and settlement of industrial disputes extending beyond the limits of any one state” and not otherwise (except for Commonwealth employment and other presently not relevant purposes). And adds: “the corporations power has nothing to say about industrial relations or their regulation by the Commonwealth”.

Let us not get too cute about a legalistic interpretation – it was never the intention of those negotiating the Constitution for the States not to have this responsibility.

How do you address it with an incoming government? – that is not easy. That would require the government again to allow the option of corporations operating under a State system through a legislative change. Some States like Victoria handed over their powers regardless, but States should have the option – competition worked incredibly effectively in Western Australia.

It seems that the reality is there will be some tweaking of the existing legislation not to reignite the effective union campaign against “work choices” and I do not think that is something the coalition parties should be particularly proud of because there is a need to have a system where competition between the States promotes innovation and improved productivity in our labour markets.

We freed up the labour markets. It was successful. Now we are going back to one size fits all.

Time does not permit my views on education and health.

Conclusion

In summary, what I am saying is:

● Reverse the drift of financial muscle to the centre, back to the States with a 50/50 PRRT sharing arrangement;

● Bring about more flexibility and competition inside the industrial relations system;

● Strip out the duplication which has arisen by the Federal Government wanting to be involved in areas that are State responsibility; and

● We must realise that both the major political parties have been heading down the wrong path and we need to see an indication from at least one of them, but hopefully both, that they are prepared to reverse that trend.

AustLII:

Copyright Policy

|

Disclaimers

|

Privacy Policy

|

Feedback

URL: http://www.austlii.edu.au/au/journals/SGSocUphAUCon/2012/7.html